- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: September 6, 2012

September 6

September 62012

Rating Agencies Raise Korea’s Credit Grade, Won Strengthens

The South Korean won gained today after Fitch Ratings raised the nation’s credit rating, following the same move by Moody’s Investor Service. The decision was explained by the ability of South Korea to withstand the negative influence from the global economic slowdown. Fitch increased Korea’s sovereign grade to AA-, the same rating as Saudi Arabia has and one notch above Japan’s and China’s rates. Earlier, Moody’s upgraded South Korea one notch […]

Read more September 6

September 62012

Good News Make CAD Stronger, Even More Good News Expected Tomorrow

The Canadian dollar jumped today on the favorable fundamental reports from the United States. The US data added to the positive mood of Forex traders that was caused by the announcement of debt purchases by the European Central Bank. US employment grew by 201,000 jobs in August from July, according to the report of Automatic Data Processing. The unemployment claims fell from 377,000 to 365,000 last week. The positive US data added to the optimism caused by the ECB. Europe’s […]

Read more September 6

September 62012

Ruble Gains on Oil Prices & Risk Appetite

The Russian ruble advanced today as prices for crude oil, country’s major export, rose and the Forex market sentiment was favorable to riskier currencies after the European Central Bank announced its asset-purchase program. Futures on Brent crude oil climbed as much as 1.4 percent to $114.73 per barrel in New York, rising for the second day. Crude oil and natural gas makes up about 50 percent of Russia’s export revenue. The ECB announced […]

Read more September 6

September 62012

ECB Maintains Rates and Initiates Bond Buying, Euro Jumps

The euro was stronger today European Central Bank President Mario Draghi left the key minimum bid rate unchanged and detailed the program of unlimited sterilized purchases of sovereign bonds. Such decision was expected by Forex market participants, but was well-received nevertheless. The ECB left its main interest rate at 0.75 percent. Draghi explained in the statement: Owing to high energy prices and increases in indirect taxes in some euro area […]

Read more September 6

September 62012

UK Pound Remains Mostly Steady Against Majors

UK pound is mostly steady today following the latest Bank of England decision. Sterling is mostly rangebound against other majors, making little changes as Forex traders await the latest plan from the ECB about how to fix the sovereign debt crisis. The BOE’s Monetary Policy Committee announced that it would keep the interest rate the same, and it would also maintain the same level in its asset repurchase […]

Read more September 6

September 62012

Risk Appetite Returns, Putting US Dollar on the Back Foot

US dollar is headed lower, thanks to the return of risk appetite. The news that the ECB will not cut interest rates is helping the euro against the greenback. General risk appetite means that Forex traders aren’t looking for safe haven, and that the US dollar is likely to remain lower for a while. Greenback is paring some of its losses against the euro with the latest ADP report for August. The news […]

Read more September 6

September 62012

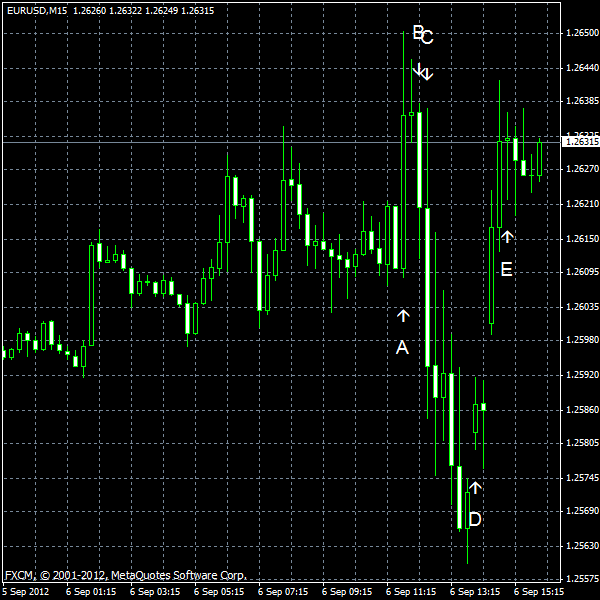

EUR/USD Jumps as ECB Initiates Bond Purchases

EUR/USD climbed today after the European Central Bank kept its interest rates unchanged and described the bond-buying program. (Event A on the chart.) Such decision was expected, but was well-received nevertheless as the asset purchases should support the indebted European countries. The news from the United States was also positive, especially the surprisingly good employment report. ADP employment rose by 201k in August from July (seasonally adjusted), pleasantly surprising […]

Read more September 6

September 62012

Aussie Climbs on Unexpected Drop of Unemployment Rate

The Australian dollar rose today as the unemployment rate unexpectedly fell last month. The currency went higher even as Australian employment shrank, surprising market participants negatively as they were expecting a moderate increase. The unemployment rate fell from 5.2 percent to 5.1 percent in August, while analysts thought it would rise to 5.3 percent. The employment change posted the drop by 8,800 jobs last month from the month before, while […]

Read more September 6

September 62012

Euro Climbs Ahead of ECB Policy Meeting

The euro jumped yesterday and retained its gains today as hopes for asset purchase plan of the European Central Bank continued to support the shared 17-nation currency and made market participants more willing to invest in European assets. Two ECB officials described the bond buying plan yesterday. The plan will focus on government bonds instead of broader range of assets. German Chancellor Angela Merkel said she can accept the program if it […]

Read more