EUR/USD climbed today after the European Central Bank kept its interest rates unchanged and described the

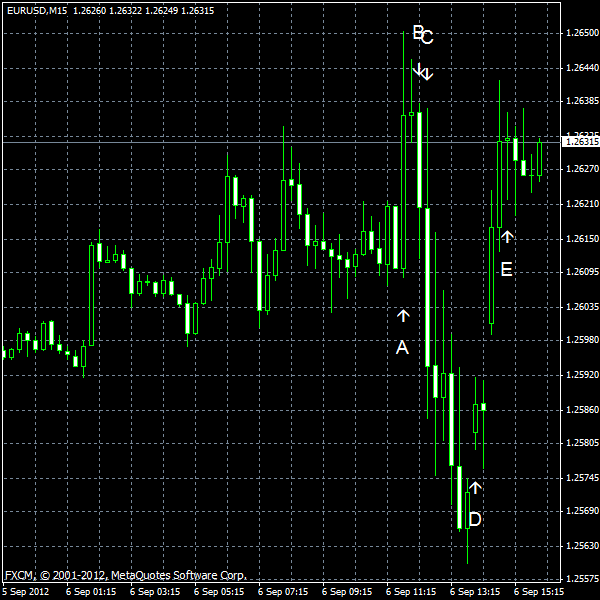

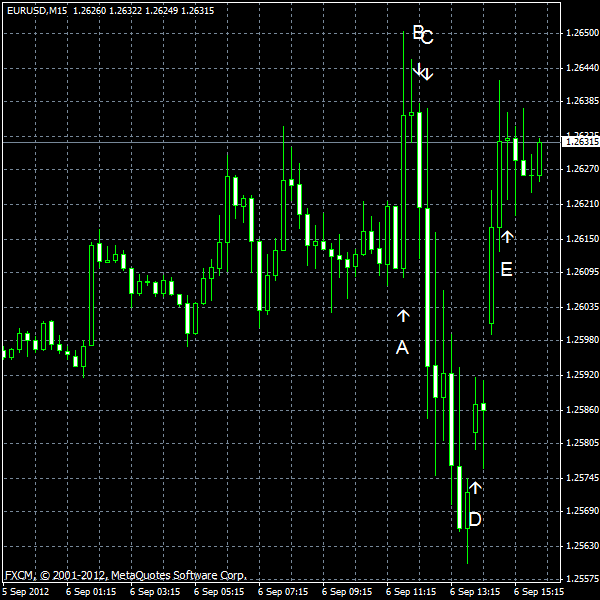

ADP employment rose by 201k in August from July (seasonally adjusted), pleasantly surprising economists as they were expecting an increase by just 142k. Moreover, the July reading was revised up from 163k to 173k. (Event B on the chart.)

Seasonally adjusted initial jobless claims fell from 377k to 365k last week. That is a little below the predictions of 367k. (Event C on the chart.)

ISM services PMI rose from 52.6% to 53.7% in August, while analysts thought it would stay little changed. (Event D on the chart.)

Crude oil inventories decreased by 7.4 million barrels last week and are near the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 2.3 million barrels and are in the lower half of the average range. (Event E on the chart.)

Yesterday, a report on nonfarm productivity was released, showing the annual increase by 2.2% in the second quarter of 2012, compared to the preliminary estimate of 1.6% the 0.5% drop in the first quarter. The average forecast was 1.8%. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.