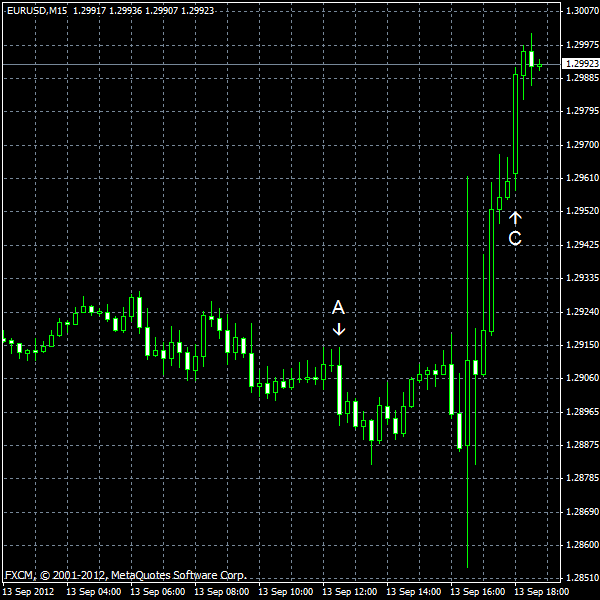

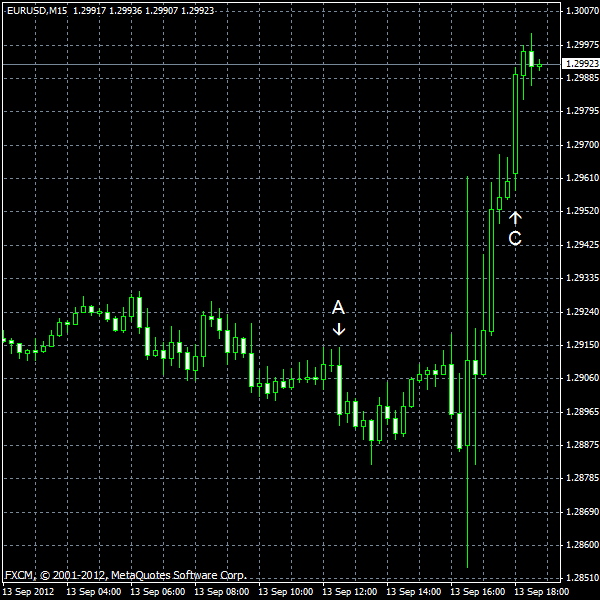

EUR/USD surged today, touching the highest level since May 9, after the Federal Reserve announced the next round of quantitative easing and extended its pledge to keep the interest rate low till mid-2015. The decision was priced in, but the currency pair jumped nevertheless. Rising unemployment claims and the swelling budget deficit suggested that the US economy indeed needs stimulus.

PPI surged 1.7% in August, demonstrating a bigger increase than the predicted 1.1% and the July change of 0.3%. (Event A on the chart.)

Initial jobless claims jumped from 367k to 382k last week. Much smaller increase to 370k was predicted by market analysts. (Event A on the chart.)

FOMC announced the third round of quantitative easing:

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee agreed today to increase policy accommodation by purchasing additional agency

The Committee reiterated that the Operation Twist will be extended to the end of this year. On top of that, the interest rates are expected to remain low at least till mid-2015. (Event B on the chart.)

Treasury budget deficit swelled from $69.6 billion in July to $190.5 billion in August. Economists predicted that the deficit would be at $156.1 billion. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.