- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: September 14, 2012

September 14

September 142012

Japanese Yen Tanks on QE3, Growth Downgrade

Japanese yen is headed lower today, dropping as risk appetite is the focus of many Forex traders following the quantitative easing announcement out of the United States. Earlier, Japanese leaders downgraded the assessment for Japan’s economy, and that is weighing a bit as well. As Forex traders turn to riskier assets, thanks to the latest announcement from Ben Bernanke and the Federal Reserve, the Japanese yen is heading lower. There is no need […]

Read more September 14

September 142012

Euro at Four-Month High Following Fed QE Announcement

Euro is at a four-month high today, following yesterday’s quantitative easing announcement from the Federal Reserve. The news has devalued the dollar considerably, and given the euro a boost. Ben Bernanke announced an open-ended quantitative easing program which involves buying mortgage back securities and other assets at a rate of $40 billion a month until the Fed determines that the program is no longer needed. Additionally, the promise is of low interest rates […]

Read more September 14

September 142012

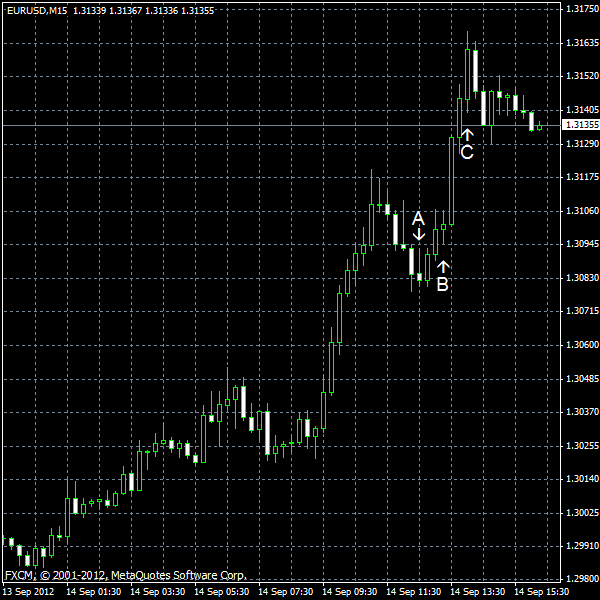

EUR/USD at 4-Month High

EUR/USD rallied today to the highest level since May 4 as yesterday’s announcement of QE3 continued to weigh on the dollar. As for macroeconomic reports from the United States, the data was mixed, but important indicators like retail sales, CPI and consumer sentiment were positive. Retail sales rose 0.9% in August from July, compared to the forecast of 0.7%. The July increase was revised down from 0.8% to 0.6%. (Event A on the chart.) CPI increased […]

Read more September 14

September 142012

Swedish GDP Growth Revised Down, Krona Dips

The Swedish krona declined today after Sweden’s economic growth in the last quarter was revised down. The currency lost the appeal caused by the improving outlook for the future of the European economy. Swedish gross domestic product expanded 1.3 percent in the second quarter of 2012 from a year ago. The previous estimate was 2.3 percent. The bond-buying program of the European Central Bank improved the outlook for European countries and the Federal Reserve’s QE3 added to risk appetite […]

Read more September 14

September 142012

Chile’s Central Bank Keeps Key Rate at 5%, Peso Stays Flat

Yesterday, the Chilean central bank kept its benchmark interest rate unchanged for the eight consecutive month and increased its growth forecast. The Chilean peso was flat today. The Central Bank of Chile kept its main interest rate at 5 percent. The bank noted the positive developments in Europe: Internationally, global financial conditions have improved and the financial tensions in the Eurozone have moderated after the announcements of the European Central Bank. However, there […]

Read more September 14

September 142012

Aussie Gets to Monthly High with Help from Fed

The Australian dollar traded near the highest level in a month against its US counterpart and was at September’s high versus the Japanese yen after the Federal Reserve announced quantitative easing, spurring risk trading on the Forex market. The anticipation of Fed’s monetary decision was driving the FX market for the whole week. The central bank made an announcement of QE3 and growth-related currencies surged to the upside. Now traders’ attention will turn to Europe once again […]

Read more