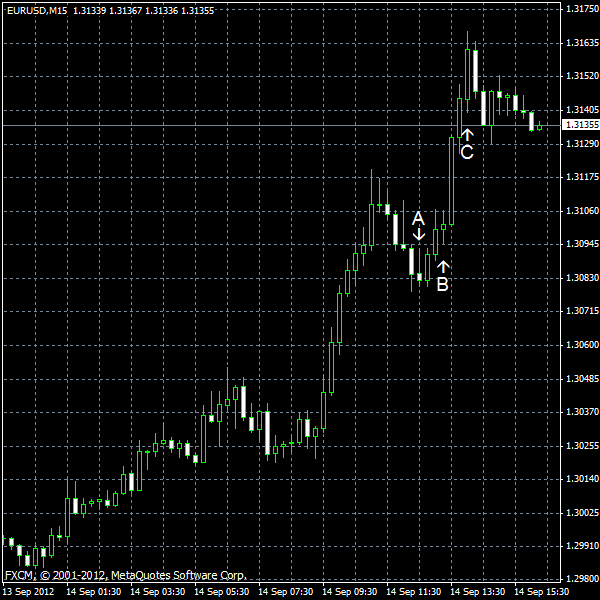

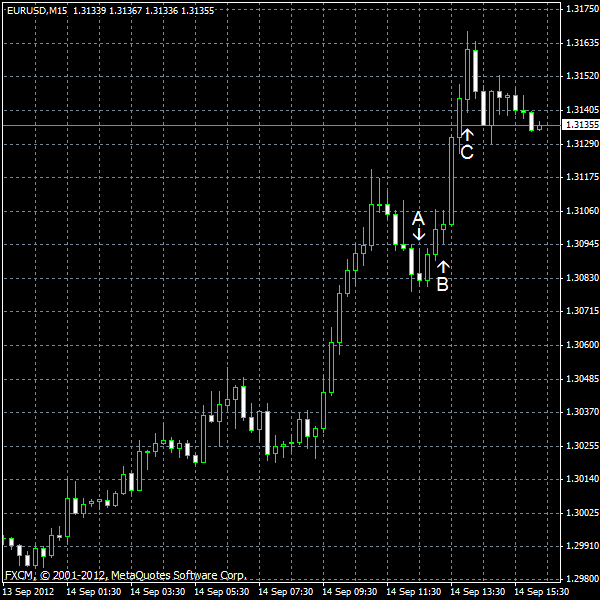

EUR/USD rallied today to the highest level since May 4 as yesterday’s announcement of QE3 continued to weigh on the dollar. As for macroeconomic reports from the United States, the data was mixed, but important indicators like retail sales, CPI and consumer sentiment were positive.

Retail sales rose 0.9% in August from July, compared to the forecast of 0.7%. The July increase was revised down from 0.8% to 0.6%. (Event A on the chart.)

CPI increased 0.6% in August on a seasonally adjusted basis, being near the forecast figure of 0.5%. The index registered no change in July. (Event A on the chart.)

Industrial production and capacity utilization unexpectedly fell in August. Industrial production was down 1.2%, following the 0.5% advance in July. Capacity utilization rate was at 78.2%, down from the previous value of 79.2%. Analysts’ estimates ahead of the report were 0.1% and 79.3% respectively. (Event B on the chart.)

Michigan Sentiment Index rose to 79.2 in September from the last month’s 74.3 (revised up from 73.6), according to the preliminary estimate. That was a pleasant surprise as specialists predicted a drop to 74.1. (Event C on the chart.)

Seasonally adjusted business inventories grew 0.8% in July. The change was bigger than the predicted 0.3% and the June’s rise by 0.1%. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.