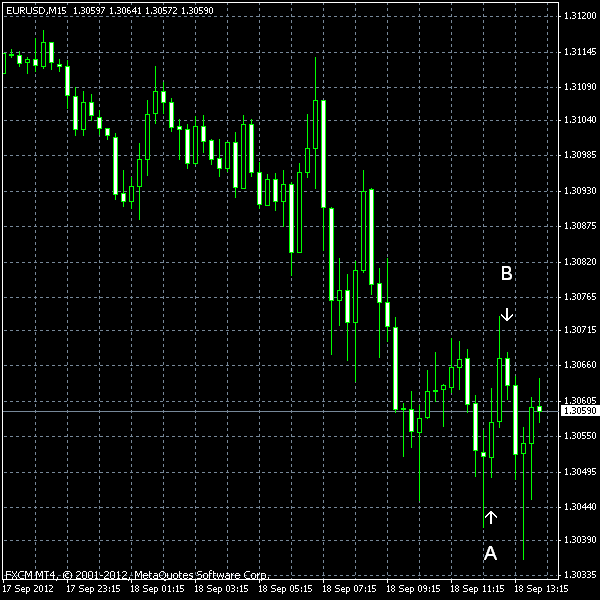

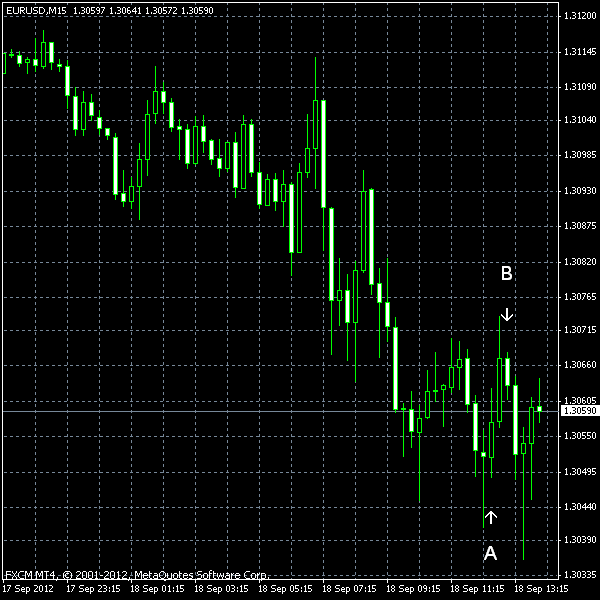

The US dollar strengthened against the euro today following poor business sentiment releases from Europe and quite optimistic macroeconomic reports from the United States. The currency pair halted its growth yesterday after setting the highest price level since early May and is now heading down in a correction.

US current account balance deficit tightened to $117.4 billion in second quarter of 2012, while the figure for the previous quarter was revised from $137.3 billion to $133.6 billion. The market participants expected the deficit to decrease to $125 billion. (Event A on the chart.)

Net foreign purchases of the

Yesterday, the report on the Empire State Manufacturing Survey was released by the New York Fed. It has shown a drop of the sentiment index from -5.85 to -10.4 in September. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.