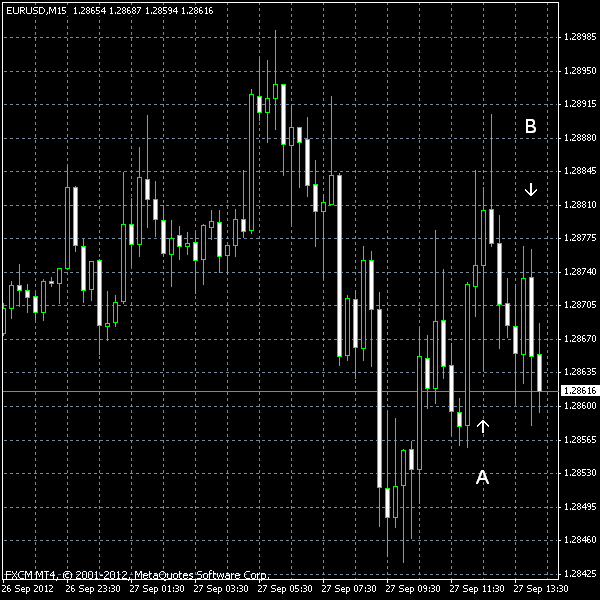

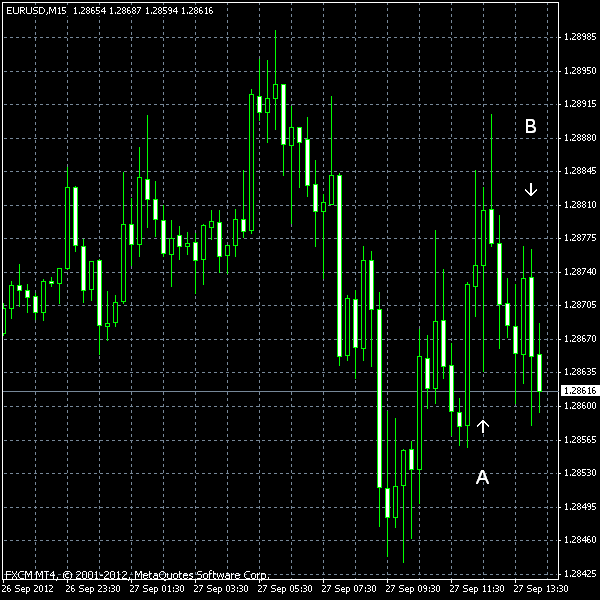

Although there was a significant jump in volatility following the most important macroeconomic releases that came out of the United States today, the euro/dollar pair failed to show any directed movement beyond the early session’s trend. EUR/USD is still trading not too deep below its daily open level.

The US GDP growth rate for the second quarter of 2012 was unexpectedly revised down to 1.3% in its third estimate. That is considerably below 1.7% reported earlier. The market experts forecasted no change for this revision. (Event A on the chart.)

Durable goods orders registered a tremendous drop in August — 13.2%. The figures came out far worse than the analysts expected (5% drop). The July growth was revised from 4.2% to 3.3%. (Event A on the chart.)

Initial jobless claims presented a better surprise for the dollar bulls — 359k for the last week, down from 385k a week earlier (revised from 382k) and quite below the estimate of 375k. (Event A on the chart.)

Pending home sales declined by 2.4% in August following 2.6% increase in July (revised positively from 2.4% growth). The median forecast for this indicator’s August change was 0%. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.