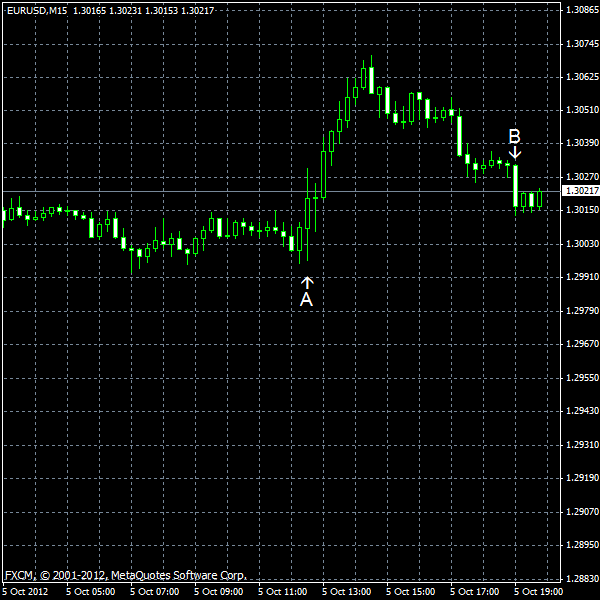

EUR/USD jumped to the highest level since September 19 today after the US unemployment rate unexpectedly dropped to the lowest level January 2009. Nonfarm payrolls showed robust growth and the previous reading, which was considered disappointing by traders, received a significant positive revision. Consumer credit was much higher than the forecast value. The risk sentiment turned positive today and traders preferred the euro to the dollar. Yet the shared European currency quickly lost its gains and stays not far from the opening level at present.

Nonfarm payrolls rose 114k in September, matching forecasts exactly. The August change was revised positively from 96k to 142k. The unemployment rate was down from 8.1% to 7.8%. That was an unexpected event as market analysts have thought that it would rise to 8.2%. (Event A on the chart.)

Consumer credit grew $18.1 billion in August from July, much more than forecasters have promised — $6.8 billion. On top of that, the July drop was revised from $3.3 billion to $2.5 billion. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.