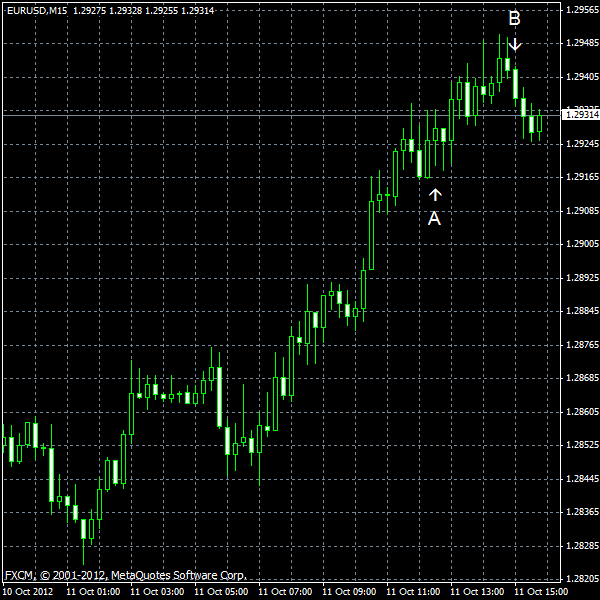

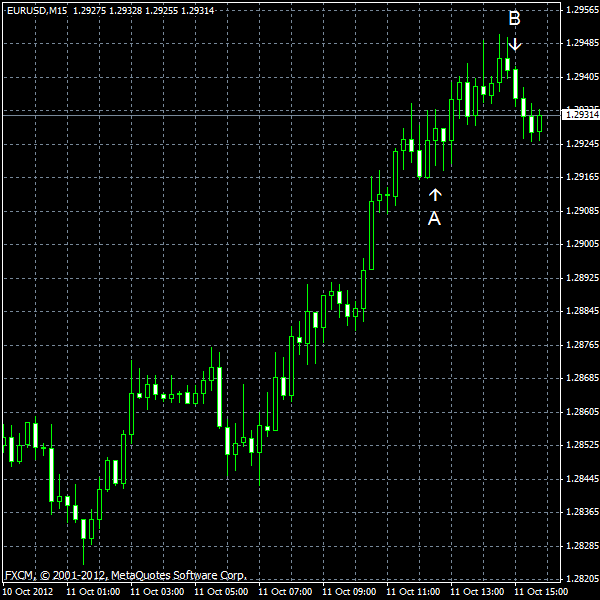

EUR/USD climbed today on hopes that Spain will ask for a bailout. Earlier, the currency pair dipped as Standard & Poor’s cut the nation’s credit rating. Demand for the dollar as a safe haven decreased after US unemployment claims unexpectedly fell.

US trade balance deficit was $44.2 billion in August, matching analysts’ estimates, up from $42.5 billion in July. (Event A on the chart.)

Initial jobless claims fell to 339k last week, while they were expected to stay little changed from the previous reading of 369k. (Event A on the chart.)

Import and export prices rose in September. Import prices advanced 1.1%, the same as in August (revised from 0.7%), while the median forecast was 0.7%. Export prices grew 0.8%, following a 1.0 percent advance in August. (Event A on the chart.)

Crude oil inventories increased by 1.7 million barrels last week and are above the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 0.5 million barrels and are near the lower limit of the average range. (Event B on the chart.)

Yesterday, the report on wholesale inventories was released, showing an increase by 0.5% August, which was in line with forecasts. The July rise was revised from 0.7% to 0.6 percent. (Not shown on the chart.)