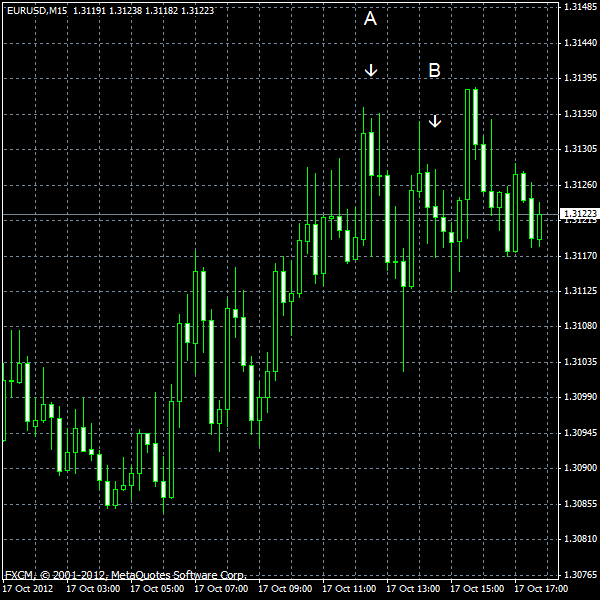

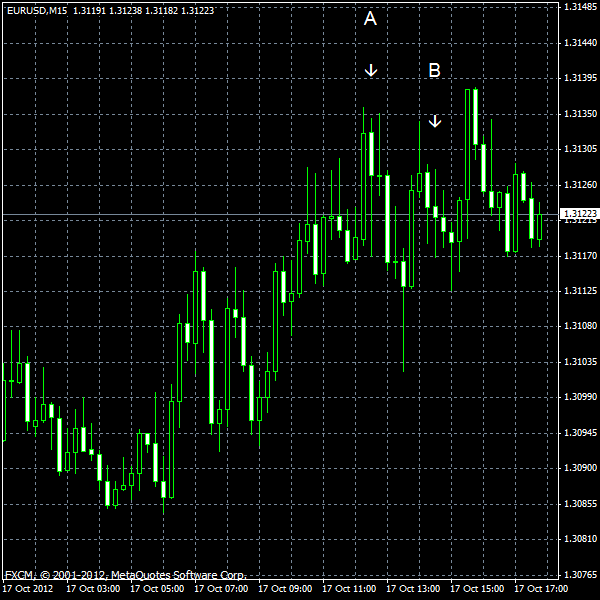

Today, EUR/USD touched the highest level in a month ahead of tomorrow’s meeting of European leaders in Brussels. Investors hope that the summit will help to find a way for Greece to remain in the eurozone. Moody’s Investor Service refrained from lowering Spain’s credit rating, adding to optimism. Most of US macroeconomic reports were also good for the market sentiment.

Housing starts and building permits grew in September. Housing start advanced from 758k to 872k and building permits increased from 801k to 894k (both on a seasonally adjusted basis). That is compared to market expectations of 770k and 810k respectively. (Event A on the chart.)

Crude oil inventories increased by 2.9 million barrels and total motor gasoline inventories increased by 1.7 million barrels last week. (Event B on the chart.)

Yesterday, several reports were released.

CPI rose 0.6% in September, demonstrating the same rate of growth as in August. The consensus forecast was 0.4%. (Not shown on the chart.)

Net foreign purchases was at $90.0 billion in August, rising from the revised $67.2 billion in July. Decline to $45.3 billion was expected by market analysts. (Not shown on the chart.)

Industrial production and capacity utilization improved in September. Industrial production rose 0.4%, compared with expectations of 0.2% growth, while capacity utilization was at 78.3%, in line with forecasts. The August figures were revised negatively, from -1.2% to -1.4% and from 78.2% to 78.0% respectively. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.