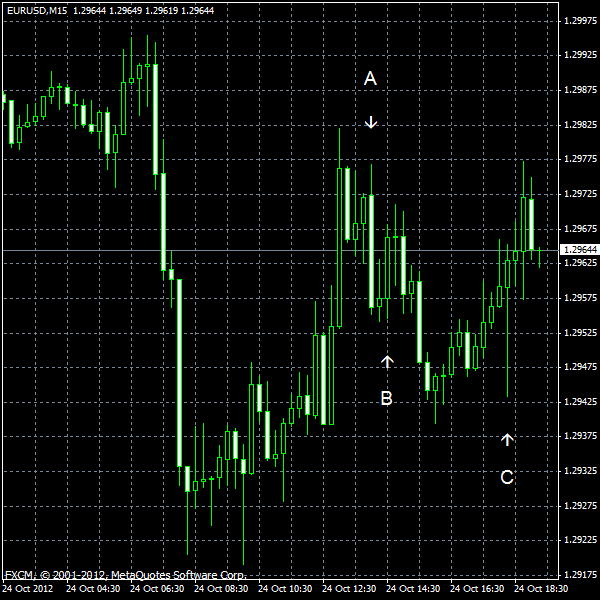

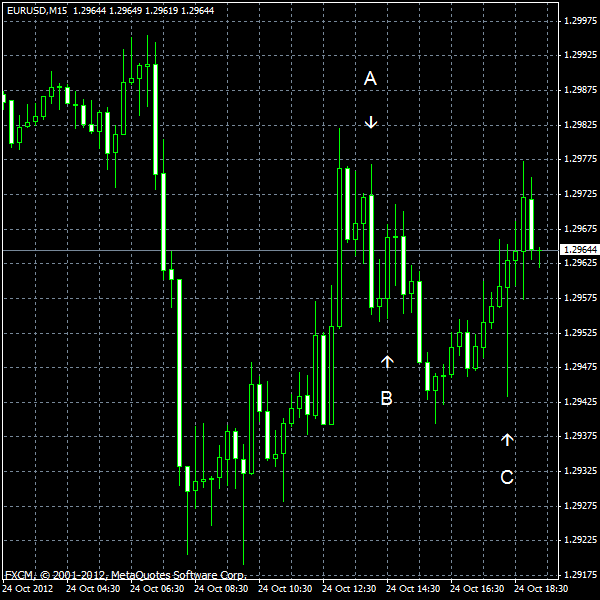

EUR/USD was weak today on signs that the European economy struggles amid the financial crisis. The policy meeting of the US central bank did not help the currency pair as the Federal Reserve did not change its stance.

New home sales were at the seasonally adjusted rate of 389k in September, higher that the August rate of 368k (revised from 373k) and the forecast of 386k. (Event A on the chart.)

Crude oil inventories increased by 5.9 million barrels and total motor gasoline inventories increased by 1.4 million barrels last week. (Event B on the chart.)

The Federal Open Market Committee left the main interest rate near zero, reiterated the pledge to keep rates low till at least mid-2015. (Event C on the chart.) The FOMC also said it will continue its quantitative easing program as long as unemployment remains a threat:

If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency

If you have any comments on the recent EUR/USD action, please reply using the form below.