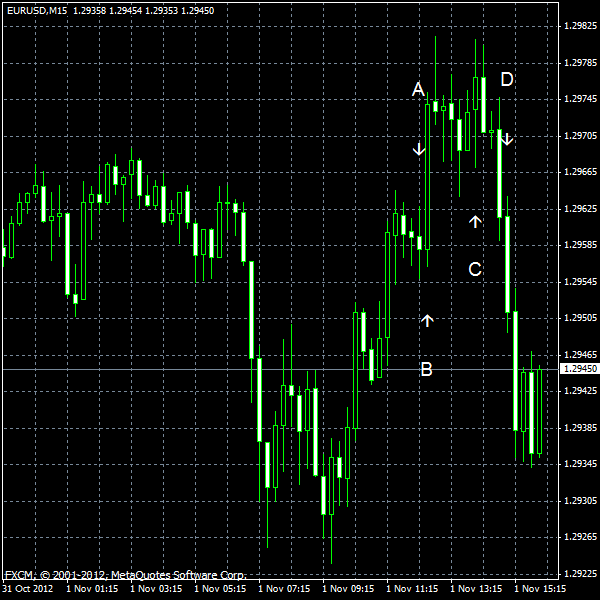

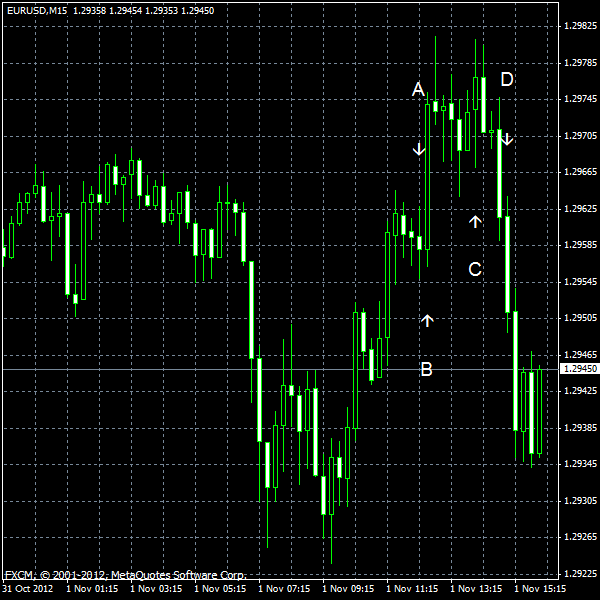

EUR/USD declined today on signs that the US economy is improving, while the future of the eurozone remains unclear. There was also negative data, but that did not hurt the dollar. This day was unusually rich on fundamental reports as releases were postponed due to the hurricane.

ADP employment demonstrated an increase of 158k in October, which was near the September’s growth of 162k. Forecasts promised a moderate rise by 138k. (Event A on the chart.)

Initial jobless claims fell from 372k to 363k last week, while market participants have thought that they would remain little changed. (Event B on the chart.)

Nonfarm productivity (preliminary) rose at the annual rate of 1.9% in the third quarter of 2012. The reading was below the Q2 rate of 2.2% (revised from 1.6%), but above the anticipated 1.3%. (Event B on the chart.)

Consumer confidence improved to 72.2 in October, following the September’s increase, matching forecasts. As for a negative part of the report, the September value was revised down from 70.3 to 68.4. (Event C on the chart.)

ISM manufacturing PMI was at 51.7 in October, a small increase from the September’s 51.5. Analysts predicted a figure of 51.2. (Event C on the chart.)

Construction spending rose at the seasonally adjusted rate of 0.6% in September from August, in line with predictions. Moreover, the previous reading was revised positively from -0.6% to -0.1%. (Event C on the chart.)

Crude oil inventories decreased by 2.0 million barrel last week from the week before and are above the upper limit of the average range for this time of year. Total motor gasoline inventories increased by 0.9 million barrels and are in the lower half of the average range. (Event D on the chart.)

Yesterday, a report on Chicago PMI was released, showing a small increase from 49.7 to 49.9 in October. The value is still below the 50.0 level, indicating decline of the industry, and that frustrated economists as they have expected a reading of 51.0. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.