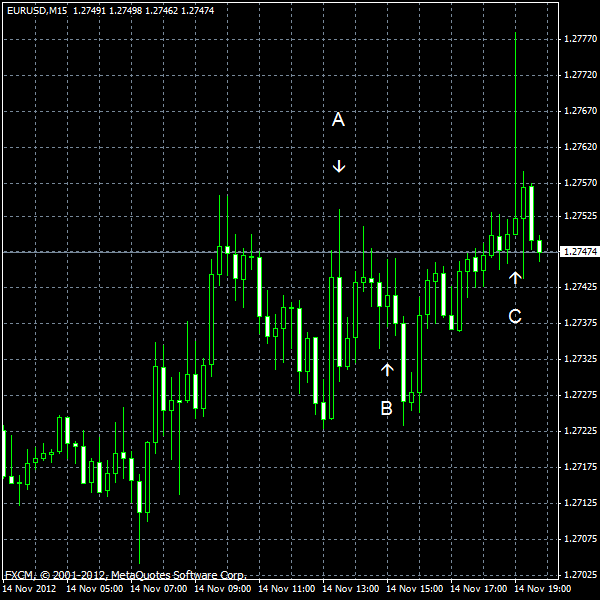

EUR/USD advanced today for the first time in five days. Fundamentals were not particularly favorable to the euro as European macroeconomic data was poor and US reports were not good either, adding to risk aversion. Yet the dollar weakened, likely because of the FOMC policy minutes. The Fed policy makers have though that additional quantitative easing may be appropriate and that is bearish for the US currency.

PPI fell 0.2% in October, while an increase by the same rate was expected by market participants. The index rose 1.1% in September. (Event A on the chart.)

Retail sales declined 0.3% in October from September, when they grew 1.3%. The actual data was in line with analysts’ forecast of a 0.2% drop. (Event A on the chart.)

Business inventories grew 0.7% in September, following 0.6% growth in August. The median forecast was 0.5%. (Event B on the chart.)

FOMC minutes of the October policy meeting were released today, showing that some policy makers believe in necessity of additional stimulus (event C on the chart):

Looking ahead, a number of participants indicated that additional asset purchases would likely be appropriate next year after the conclusion of the maturity extension program in order to achieve a substantial improvement in the labor market.

Yesterday, a report on treasury budget was released, showing a deficit of $120.0 billion in October, while in September a surplus of $75.2 billion was registered. Analysts have expected a deficit of $113.5 billion. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.