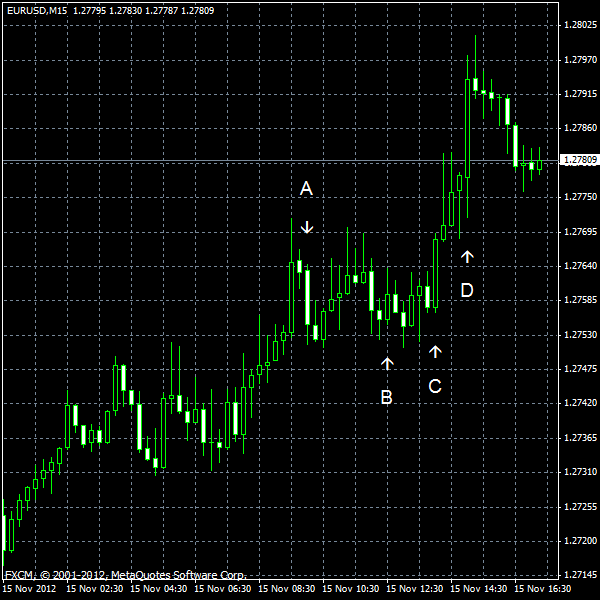

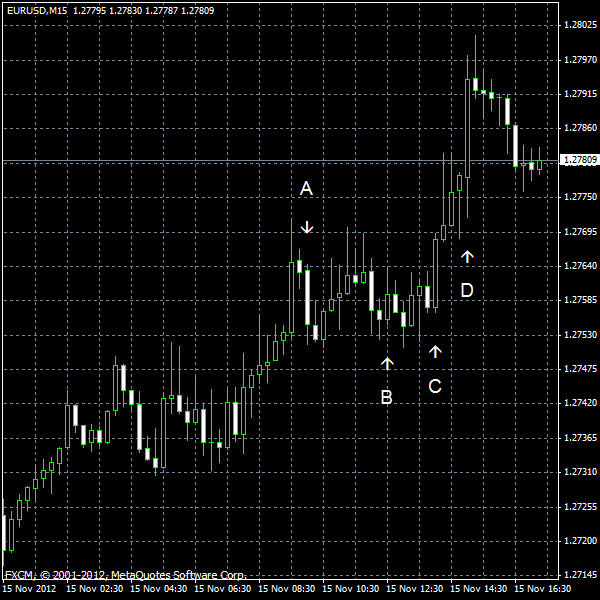

EUR/USD extended its rally today even as a report showed that the eurozone remains in recession. (Event A on the chart.) The data from the United States was somewhat mixed. That was especially noticeable in two manufacturing indices, which showed totally different performance. Most reports were worse than expected though.

Initial jobless claims jumped from 361k (revised from 355k) to 439k (seasonally adjusted) last week. Much smaller increase to 372k was expected by analysts. (Event B on the chart.)

CPI rose 0.1% on a seasonally adjusted basis in October, matching forecasts, while its growth was 0.6% in September. (Event B on the chart.)

NY Empire State Index improved to -5.2 in November from -6.2 in October instead of worsening to -7.2 as was expected. As an interesting detail, the report showed that the impact of “superstorm” Sandy was much smaller than anticipated, though it was widespread. (Event B on the chart.)

Manufacturing index of the Philadelphia Fed show totally different performance than the the Empire State index, slumping from 5.7 in October to -10.7 in November, compared to the average estimate of 1.1. (Event C on the chart.)

US crude oil inventories increased by 1.1 million barrels last week (compared to the forecast growth by 2.5 million) and are well above the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 0.4 million barrels and are in the middle of the average range. (Event D on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.