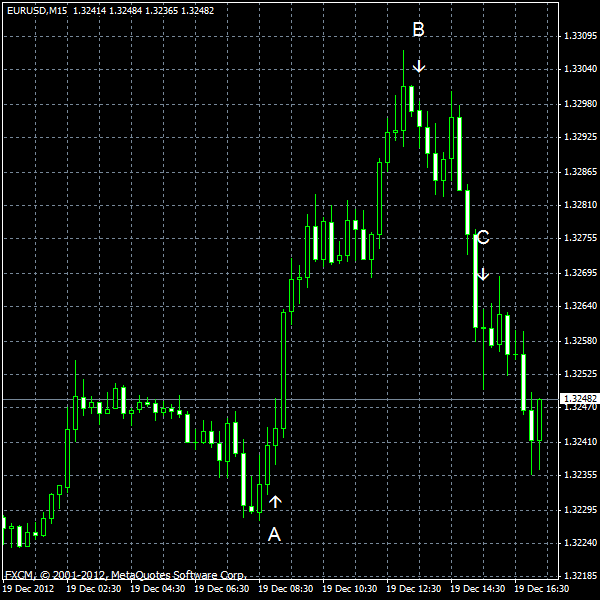

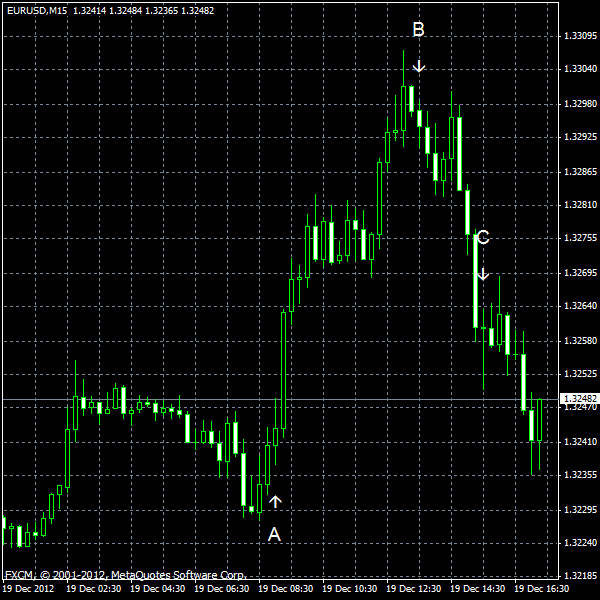

EUR/USD climbed today after German business confidence improved, beating analysts’ estimates. (Event A on the chart.) Currently though, the currency pair shows tendency to decline. The US data was in line with forecasts, therefore it is likely not the reason for the euro’s pullback.

Housing starts were at the seasonally adjusted annual rate of 861k in November, below the revised October estimate of 888k. Housing starts were at the seasonally adjusted annual rate of 899k, above the revised October rate of 868k in November. The data was in line with analysts’ predictions. (Event B on the chart.)

Crude oil inventories decreased by 1.0 million barrels (matching market expectations) and are well above the upper limit of the average range for this time of year. Total motor gasoline inventories increased by 2.2 million barrels last week and are above the upper limit of the average range. (Event C on the chart.)

Yesterday, a report on current account balance was released, showing a decrease of the deficit to $107.5 billion (preliminary) in the third quarter of 2012 from $118.1 billion (revised) in the second quarter. The actual value was in line with forecasts of $105 billion. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.