- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: January 3, 2013

January 3

January 32013

Euro Loses Ground on Risk Aversion

Euro is heading lower today, losing ground as risk aversion returns to the Forex market. Concerns about the next big budget battle in the United States are already surfacing, and that is weighing on risk appetite, and sending the euro lower. In the eurozone, concerns about recession are still lingering in the background. And, thanks to renewed concerns about the future, German Bunds have steadied after a recent sell-off. The news indicates a move […]

Read more January 3

January 32013

US Dollar Gains Ground as Uncertainty Returns

The euphoria is ended and now the uncertainty has set in. Concerns about the next big budget battle are weighing on risk appetite in the Forex market, and the US dollar is gaining as a result. Greenback is higher against high beta currencies like the euro and the pound today, gaining ground as concerns about what’s next in the budgetary battle over the fiscal cliff and the debt ceiling take center stage. Only the tax situation […]

Read more January 3

January 32013

Rand Retreats as Euphoria Quickly Wears Off

The South African rand retreated today on speculations that US politicians will not be able to raise the debt ceiling and as such concerns deterred investors from buying riskier assets. Amid all the euphoria on the Forex market yesterday, it was hard to believe that the decline of some currencies at the beginning of today’s session was anything but a small correction. Yet now it looks like optimism was short-lived and as one […]

Read more January 3

January 32013

Pound Sinks as UK Housing Sector in Trouble

The Great Britain pound slumped today as the fundamental data suggested that Britain’s housing sector is struggling, leading to fears that economy recovery in the United Kingdom may stall. The House Price Index of Nationwide Building Society fell 0.1 percent in December, following no change in the prior month. Analysts have expected a 0.1% percent increase. Moreover, the Markit/CIPS construction Purchasing Managers’ Index fell from 49.3 in November to 48.7 […]

Read more January 3

January 32013

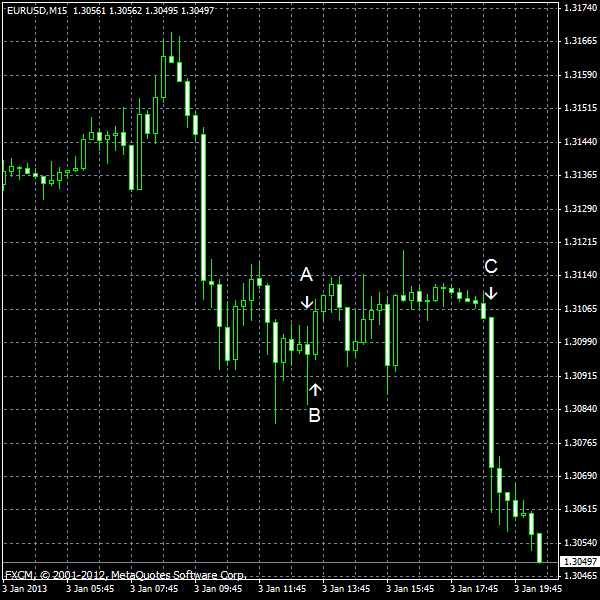

EUR/USD Slumps as Fear Returns to FX Market

EUR/USD dropped today as fears returned to the Forex market. Now, as the problem of the fiscal cliff is gone, traders are concerned about the US debt ceiling. The data from the United States was mixed as the ADP employment rose much more than expected, but jobless claims unexpectedly advanced. The dollar was also supported by the minutes of the FOMC meeting, which suggested that QE may end as soon as the end of this year […]

Read more January 3

January 32013

AUD Falls a Little vs. USD & JPY, Extends Rally vs. EUR

The Australian dollar turned down a bit against the US dollar and the Japanese yen today. It is not surprising considering how huge yesterday’s rally was. The Aussie continued its rise versus the euro. Commodity currencies were rallying yesterday as US politicians compiled a bill that will prevent an automatic tax hikes and spending reductions that could push the US economy into a recession. The Standard & Poorâs GSCI […]

Read more