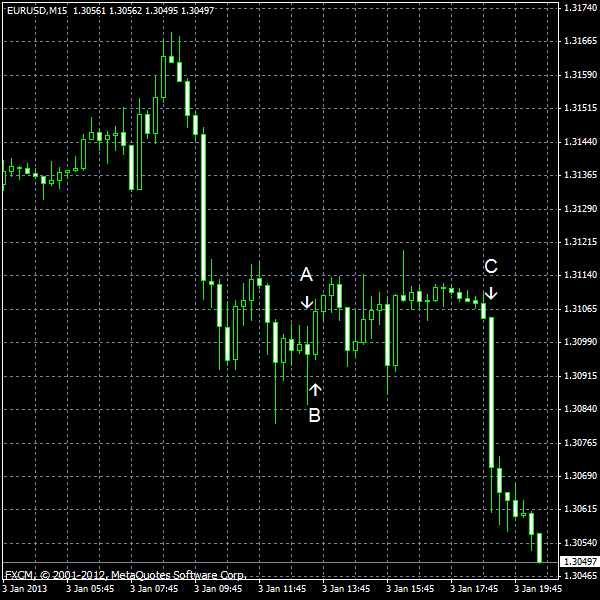

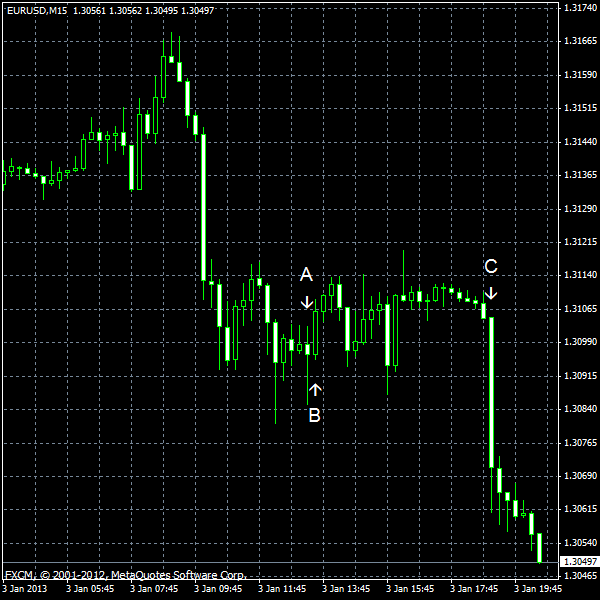

EUR/USD dropped today as fears returned to the Forex market. Now, as the problem of the fiscal cliff is gone, traders are concerned about the US debt ceiling. The data from the United States was mixed as the ADP employment rose much more than expected, but jobless claims unexpectedly advanced. The dollar was also supported by the minutes of the FOMC meeting, which suggested that QE may end as soon as the end of this year or even sooner.

ADP employment rose as much as 215k in December, demonstrating growth that was far greater than the anticipated 134k. And that is not all the good news: the November reading was revised from 118k up to 148k. (Event A on the chart.)

Initial jobless claims were at the seasonally adjusted level of 372k last week, above the predicted figure of 356k. Moreover, the previous value was revised from 350k to 362k. (Event B on the chart.)

The minutes of the last FOMC policy meeting showed that quantitative easing may end much sooner than was anticipated (event C on the chart):

In considering the outlook for the labor market and the broader economy, a few members expressed the view that ongoing asset purchases would likely be warranted until about the end of 2013, while a few others emphasized the need for considerable policy accommodation but did not state a specific time frame or total for purchases. Several others thought that it would probably be appropriate to slow or to stop purchases well before the end of 2013, citing concerns about financial stability or the size of the balance sheet. One member viewed any additional purchases as unwarranted.

If you have any comments on the recent EUR/USD action, please reply using the form below.