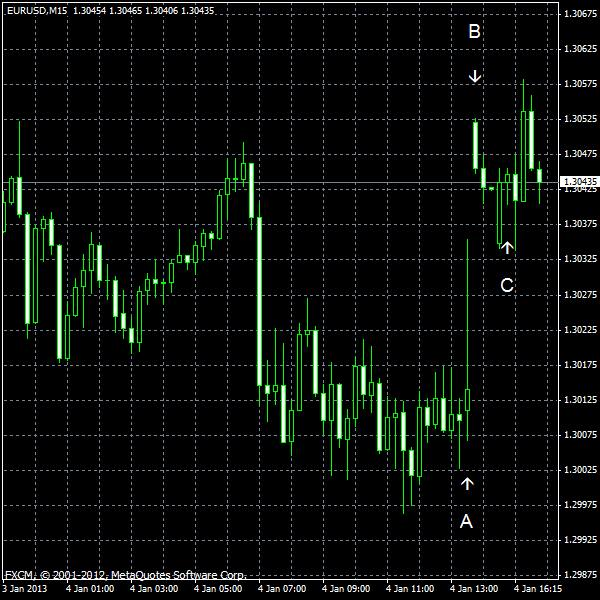

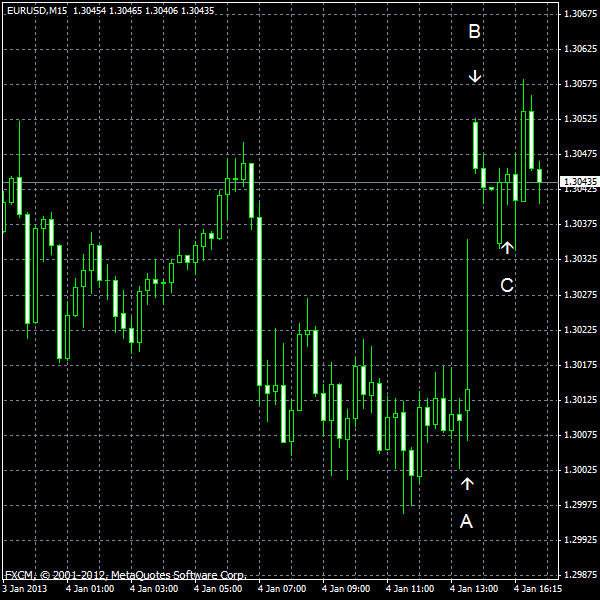

EUR/USD slowed its decline today and is staying near the opening level as of now after yesterday’s FOMC minutes sapped strength of the US dollar. Today’s nonfarm payrolls were moderately good and the services sector looked rather healthy. Yet concerns about the debt ceiling problem in the United States may yet push the currency pair further down.

Nonfarm payrolls grew by 155k in December, a little above the anticipated change of 150k. November reading was revised positively from 146k to 161k. The unemployment rate stayed in December at the revised 7.8% level of November (was at 7.7% unrevised). (Event A on the chart.)

ISM services PMI rose from 54.7% in November to 56.1% in December. The figure surprised market participants in a nice way as they were expecting a small drop to 54.2% (Event B on the chart.)

Factory orders did not grew in November from October (demonstrated no change), while analysts have predicted a 0.3% rise. The October change was 0.8%. (Event B on the chart.)

Crude oil inventories slumped as much as 11.1 million barrels to 359.9 million barrels last week (nothing near the expected decrease by 0.7 million barrels), but remained well above the upper limit of the average range for this time of year. Total motor gasoline inventories increased by 2.6 million barrels. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.