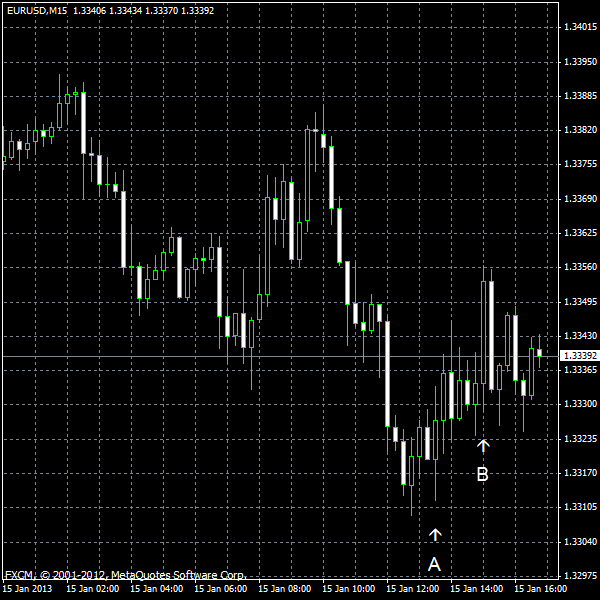

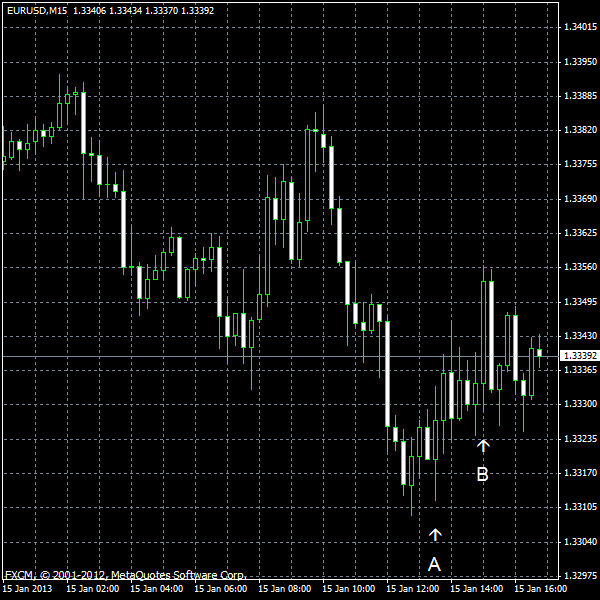

EUR/USD dropped today after three sessions of gains on poor macroeconomic reports from Europe. Some analysts speculated that the recent rally of the euro was excessive. The data from the United States was mixed as manufacturing continued to decline in New York, while retail sales grew more than was predicted.

PPI fell 0.2% in December. The drop was bigger than the predicted 0.1%, but smaller than November’s 0.8%. (Event A on the chart.)

Retail sales grew 0.5% in December, beating the median forecast of 0.2%. November growth was revised slightly from 0.3% up to 0.4%. (Event A on the chart.)

NY Empire State Index continued to show a decline as it was standing at -7.8 in January. That was a little better than December’s -8.1, but nowhere near the predicted 1.9. (Event A on the chart.)

Business inventories expanded 0.3% in November, matching forecasts and October’s rate of growth. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.