- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: January 17, 2013

January 17

January 172013

Australian Employment Negatively Surprises, AUD Suffers

The Australian dollar dropped today after the employment data turned out to be even worse than pessimistic forecasts, adding to signs of economic weakness of Australia. The currency managed to climb versus the Japanese yen. reaching the strongest level since 2008. Australian employment unexpectedly decreased 5,500 in December after rising 17,100 in November. Analysts have promised an increase by 2,300. Moreover, the unemployment rate rose to 5.4 percent as was expected and the November […]

Read more January 17

January 172013

Rand Resumes Drop Even as Strikes End

The South African rand resumed its decline against the US dollar today as fears of labor unrest in the country remain even as protests subsided and workers started to go back to work. Protesters in the Western Cape province agreed to pause their strikes to allow negotiations on wages, while Anglo American Platinum Ltd. said that its employees returned to work today. Still, worries about the continuous labor unrest remain, undermining the rand. […]

Read more January 17

January 172013

Franc Drops as Demand for Safety Wanes

The Swiss franc dropped today as demand for safety fell amid the positive market sentiment, while the Swiss fundamental data made investors question the safe status of the currency. Comments of European Central Bank President Mario Draghi about strong capital inflows into the European region helped to reduce pessimism among Forex traders. Falling yield on Spanish government bonds also added to the positive sentiment. Fundamental reports from Switzerland were […]

Read more January 17

January 172013

Euro Gains as Spanish Auction Deemed a Success

Euro is gaining today as the latest Spanish auction is considered a success. There is optimism about what’s next for the eurozone right now, and that is translating into gains for the euro, which some think could rise to the 1.3400 level against the US dollar fairly soon. Euro is benefitting from a combination of optimism and risk appetite today, heading higher as the Spanish bond auction is considered a success. Also […]

Read more January 17

January 172013

Canadian Dollar Inches Higher against US Dollar

Canadian dollar has inched higher against the US dollar, gaining some ground after slipping earlier in trading. Loonie is finding some support, even after some disappointing economic news. Earlier, Canadian dollar moved a little bit lower on reports of a decrease in foreign investment. Due to the way that Canada weathered the financial crisis and subsequent recession, many countries have been investing in the country. However, Statistics Canada […]

Read more January 17

January 172013

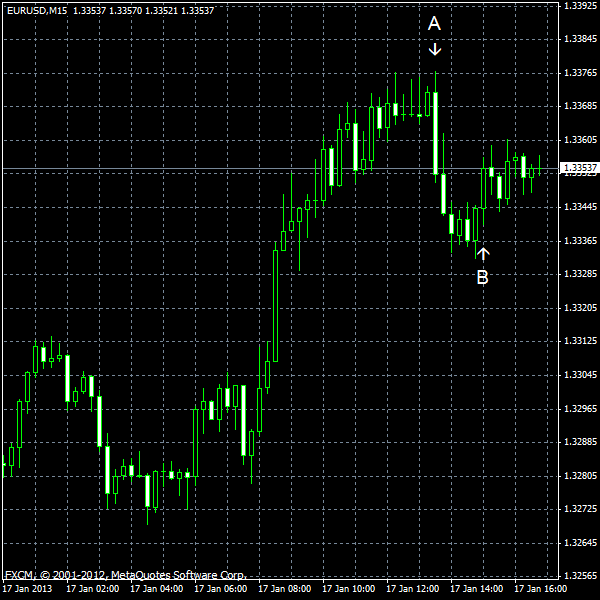

EUR/USD Climbs with Falling Yield on Spanish Debt

EUR/USD advanced today as Spain’s borrowing costs fell, demonstrating that the creditworthiness of European countries is improving. The US housing market continued to look strong, while the manufacturing sector again showed signs of weakness. Housing starts were at the seasonally adjusted annual rate of 954k in December, above the forecast of 890k and the November rate of 851k. Housing starts were at the seasonally adjusted annual rate of 903k, little changed from the November’s 900k […]

Read more January 17

January 172013

Norwegian Policy Makers Think Krone Too Strong

The Norwegian krone fell a little against the US dollar today and may retreat even further on speculations that policy makers will try to push the exchange rate down. The currency remained firm against the euro. Norges Bank Deputy Governor Jan Qvigstad said that the strength of the currency may prevent the central bank from raising interest rates. Previously, Finance Minister Sigbjoern Johnsen suggested that the bank’s monetary policy […]

Read more January 17

January 172013

Yen Drops, Rebound Is Possible

The Japanese yen fell at the start of today’s session as traders are expecting another intervention from the Bank of Japan. The currency reduced its losses by now and may yet resume its rally. The BoJ will conduct its policy meeting next week and it is a wide-held belief that the bank will introduce additional stimulus as a measure to bolster the economy. The central bank was speaking previously about aggressive actions and there is […]

Read more