EUR/USD advanced today as Spain’s borrowing costs fell, demonstrating that the creditworthiness of European countries is improving. The US housing market continued to look strong, while the manufacturing sector again showed signs of weakness.

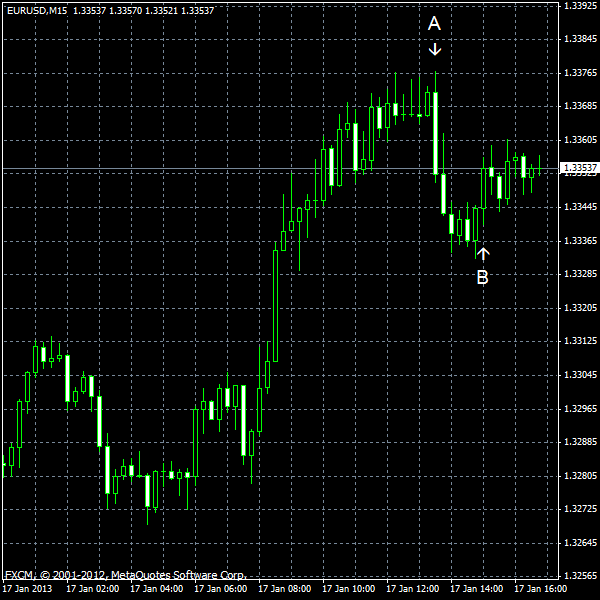

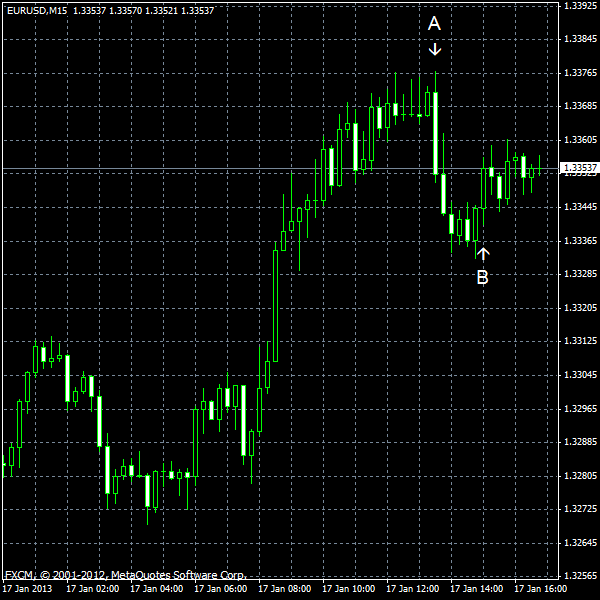

Housing starts were at the seasonally adjusted annual rate of 954k in December, above the forecast of 890k and the November rate of 851k. Housing starts were at the seasonally adjusted annual rate of 903k, little changed from the November’s 900k and matching forecasts. (Event A on the chart.)

Initial jobless claims dropped from from 372k to 335k last week. Analysts have expected just a meager decrease to 369k. (Event A on the chart.)

Philadelphia Fed Manufacturing Index decreased from the revised reading of 4.6 in December to -5.8 in January, frustrating experts who have expected a reading of 7.1. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.