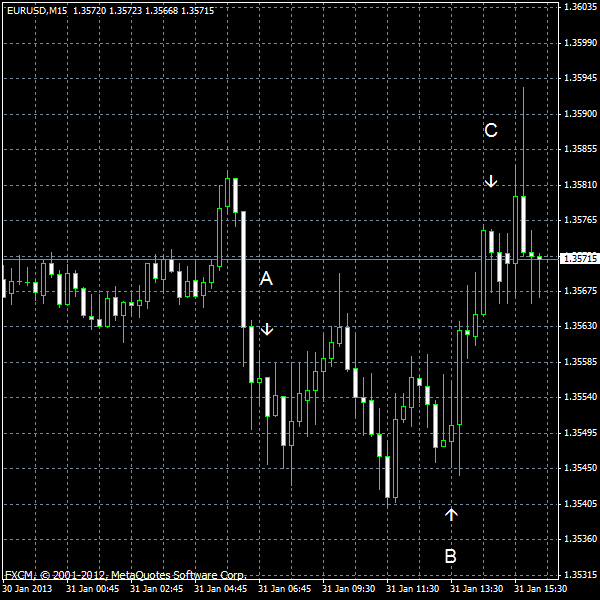

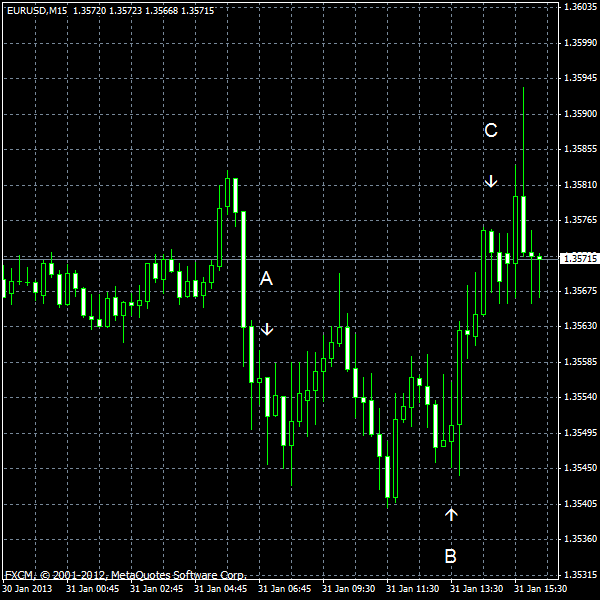

EUR/USD was falling today following yesterday’s gains, but has recovered as of now. The poor German retail sales put pressure on the currency pair to the downside (event A on the chart), but

Initial jobless claims posted rather big increase from 330k to 368k last week. The actual increase was somewhat above the forecast of 362k. (Event B on the chart.)

Personal income and spending grew in December. Income increased 2.6% last month, being above the predicted 0.7% and the previous month’s increase of 1.0% (0.6%). Spending ticked up 0.2%, while analysts have hoped it would stay at the November level of 0.4%. (Event B on the chart.)

Chicago PMI was at 55.6 in January, being high above the forecast reading of 51.1 and the December figure of 50.0 (revised from 51.6.). (Event C on the chart.)

Yesterday, a couple of reports were released.

ADP employment grew 192k in January from December, beating the forecast of 164k. The December change was revised rather substantially down from 215k to 185k. (Not show on the chart.)

GDP fell 0.1% in the fourth quarter of 2012. That was rather nasty surprise as analysts have expected an increase by 1.1%. The third quarter growth was revised from 2.0% up to 3.1%. (Not show on the chart.)

Crude oil inventories increased by 5.9 million barrels last week (the median forecast was 2.9 million) and are well above the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 1.0 million barrels and are in the upper limit of the average range. (Not show on the chart.)

The Federal Open Market Committee released the statement of its policy meeting, noting that “growth in economic activity paused in recent months”. Overall, the monetary policy remained the same, not affecting the market in a big way. (Not show on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.