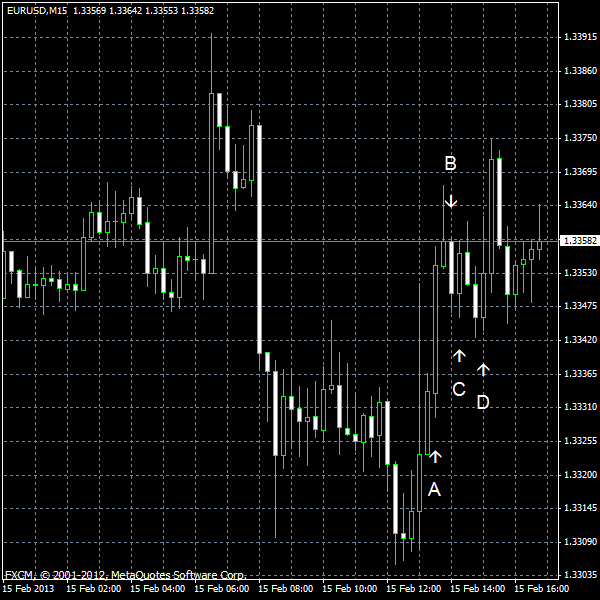

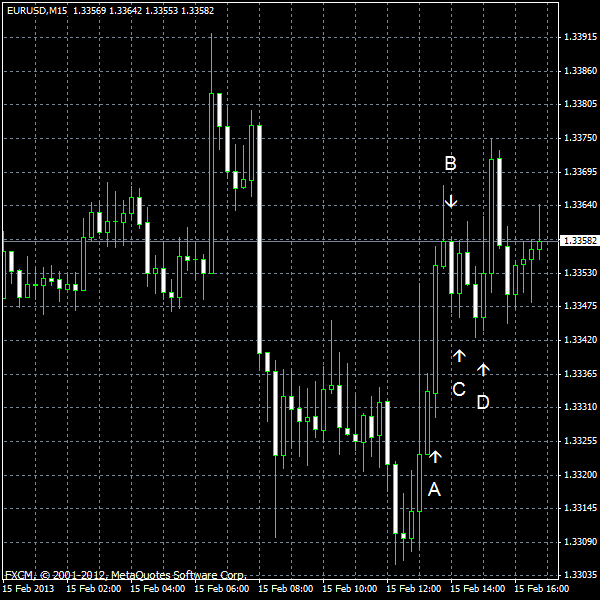

EUR/USD has gone nowhere today as traders are reluctant to take positions while outcome of the Group of Twenty meeting, which is held in Moscow, remains unclear. Currency manipulations are expected to be the main topic of the meeting. Meanwhile, the US economy was showing signs of strength as reports were surprising traders in a positive manner.

NY Empire State Index jumped from -7.8 in January to 10.0 in February. It was expected to remain in the negative territory at -2.1. The conditions for New York manufacturers improved for the first time since last year’s summer. (Event A on the chart.)

Net foreign purchases demonstrated an unexpected increase to $64.2 billion in December from the November’s $52.4 billion, while they were believed to fall to $34.3 billion. (Event B on the chart.)

Both industrial production and capacity utilization declined last month, Industrial production fell 0.1% in January, instead of rising 0.2% as was expected, following the 0.4% increase in December. Capacity utilization rate edged down by 0.2 percentage point to 79.1%, compared to the forecast of 78.9%. (Event C on the chart.)

Michigan Sentiment Index rose from 71.3 to 76.3 in February according the preliminary estimate, more than was expected (74.8). (Event D on the chart.)

Yesterday, a report on initial jobless claims was released, showing a drop from 368k to 341k last week, instead of expected 361k. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.