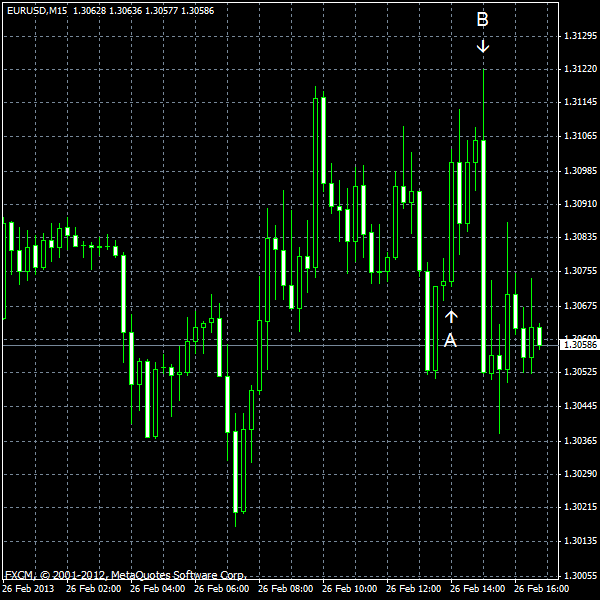

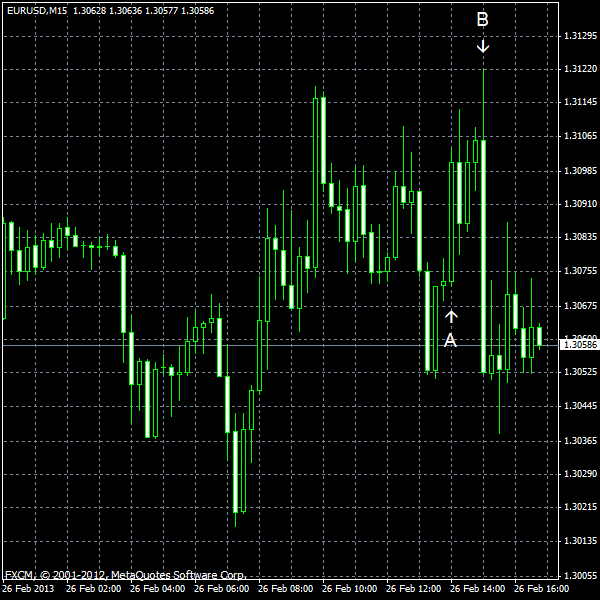

EUR/USD paused its decline after the election in Italy was concluded. The voting resulted in a divided parliament and this is exactly the outcome that made Forex traders scared and willing to sell the euro. Therefore the currency pair may yet resume its drop. In fact, the inconclusive election may spoil the performance of the euro for a long term as the political uncertainty in one of the major economies of the European Union definitely will not do well for the shared 17-nation currency. Meanwhile, the macroeconomic data from the United States eased tension among market participants as all the reports were rather good.

S&P/

Richmond Fed manufacturing index climbed from -12 in January to 6 in February. The actual report was more positive than the expectations of -4. (Event B on the chart.)

Consumer confidence climbed from 58.4 in January to 69.6 in February. Just a small increase to 60.8 was expected by market analysts. (Event B on the chart.)

New home sales jumped from 378k in December (revised up from 369k) to 437k in January on a seasonally adjusted basis, while specialists have anticipated smaller advance to 381k. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.