- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: February 28, 2013

February 28

February 282013

Euro Drops on Expectations for Continued Contraction

Euro is headed lower again, thanks to more economic data that indicates the eurozone is likely to remain in an economic contraction. Even good news out of Germany can’t change the subdued economic outlook for the entire 17-nation currency region.

Read more February 28

February 282013

Economic Expectations Weigh on Canadian Dollar

Canadian dollar is lower against its major counterparts today, dropping as economic expectations weigh on the loonie. Between GDP data to be released tomorrow, and a Bank of Canada announcement next week, there aren’t high hopes for loonie performance. Tomorrow, Statistics Canada is expected to share data about economic performance in December 2012. The report is expected to show a lower GDP, indicating contraction. Reports are expected to show […]

Read more February 28

February 282013

Franc Mixed as Swiss Economy Expands

The Swiss franc fell versus the US dollar and rose against the euro today. The Swiss economy unexpectedly grew last quarter, suggesting that the strong currency is not that detrimental to economic growth. Swiss gross domestic product expanded 0.2 percent in the fourth quarter of 2012 from the third quarter, when the economy grew 0.6 percent. This was a nice surprise as economists have expected no growth. The data suggests […]

Read more February 28

February 282013

NZ Dollar Climbs with Business Confidence

The New Zealand dollar advanced today as business confidence climbed in February. Building permits declined last month, but this did not deter the rally of the currency. ANZ business confidence jumped from 22.7 in January to 39.4 in February. It is the highest level in 19 months. Building permits fell 0.4 percent in January on a seasonally adjusted basis after rising 9.4 percent in the prior month. The currency paid attention to the good […]

Read more February 28

February 282013

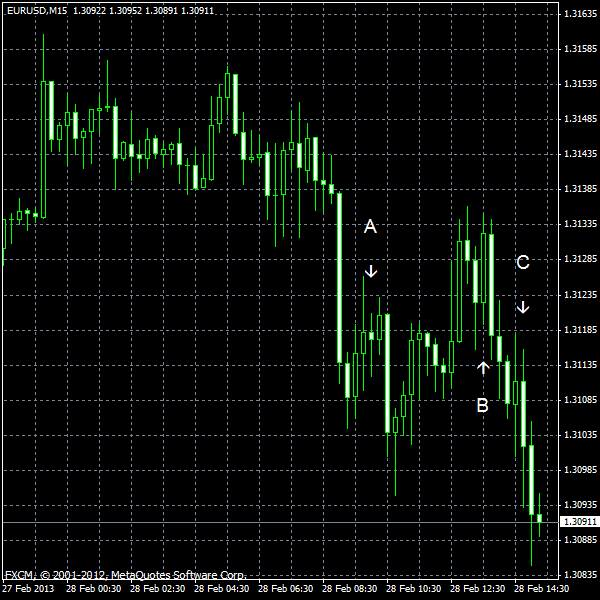

EUR/USD Drops as Inflation Slows

EUR/USD resumed its decline today as the eurozone Consumer Price Index fell from 2.2% in December to 2.0% in January on an annual basis. (Event A on the chart.) On month-over-month basis, the CPI declined 0.1%. It looked like fears about Europe came out from the market, but now are returning. The news from the United States was quite good, even considering that the US economy showed almost no growth. US […]

Read more February 28

February 282013

Yen Fluctuates After Abe Appoints Kuroda as Next BoJ Governor

The Japanese yen fell today after Prime Minister Shinzo Abe appointed Haruhiko Kuroda as the next Bank of Japan Governor. The currency bounced to the opening level as of now. Market participants speculated that President of the Asian Development Bank Kuroda, who was considered to be more aggressive on interventions than other candidates, will be the next BoJ governor. Such speculations proved true as Abe indeed nominated him the next central […]

Read more February 28

February 282013

MXN Gains as Sanchez Does Not See Reasons for Interest Rate Cut

The Mexican peso gained today as Manuel Sanchez, a member of the central bank’s board, said that he is not supporting an interest rate cut. The market sentiment was also supportive for the currency. Sanchez said yesterday in an interview to Bloomberg: At this moment in time I donât see a case for a rate cut. I would like to see a better behavior of inflation. The rigidity that inflation expectations have maintained for many, many years away from […]

Read more