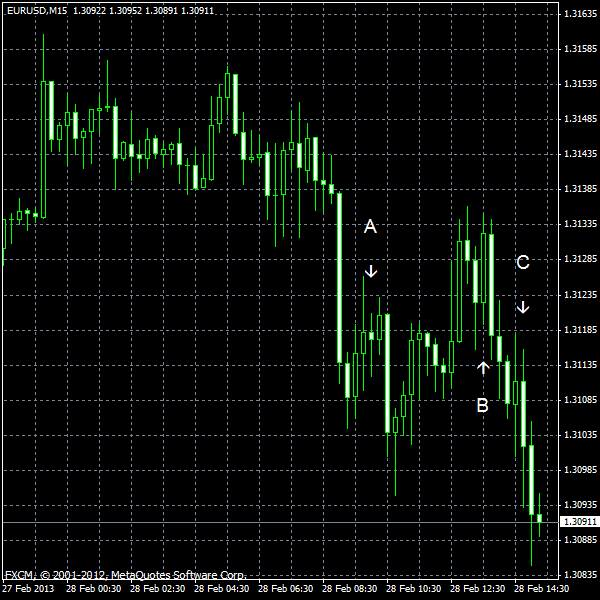

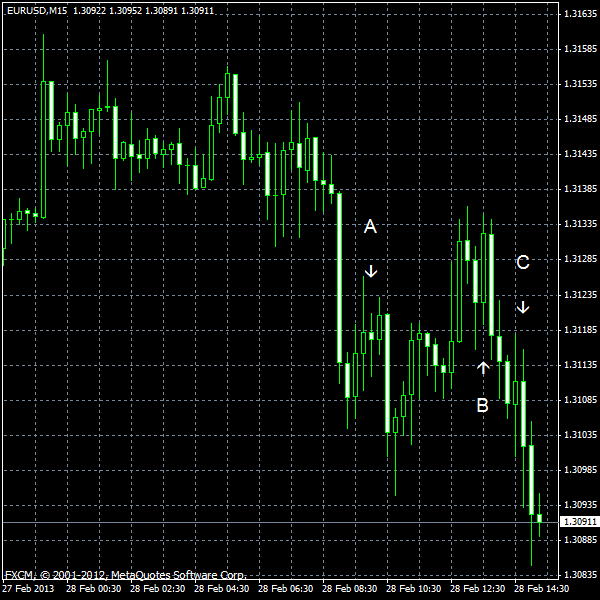

EUR/USD resumed its decline today as the eurozone Consumer Price Index fell from 2.2% in December to 2.0% in January on an annual basis. (Event A on the chart.) On

US GDP rose 0.1% in the fourth quarter of 2012, according to the preliminary estimate. The value was lower than analysts have predicted (0.5%), but higher than in the advance estimate (-0.1%). (Event B on the chart.)

Initial jobless claims dropped from 366k to 344k last week. Specialists have expected unemployment claims to little changed at 361k. (Event B on the chart.)

Chicago PMI advanced from 55.6 in January to seasonally adjusted 56.8 in February. Forecasters have promised a decrease to 54.6. (Event C on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.