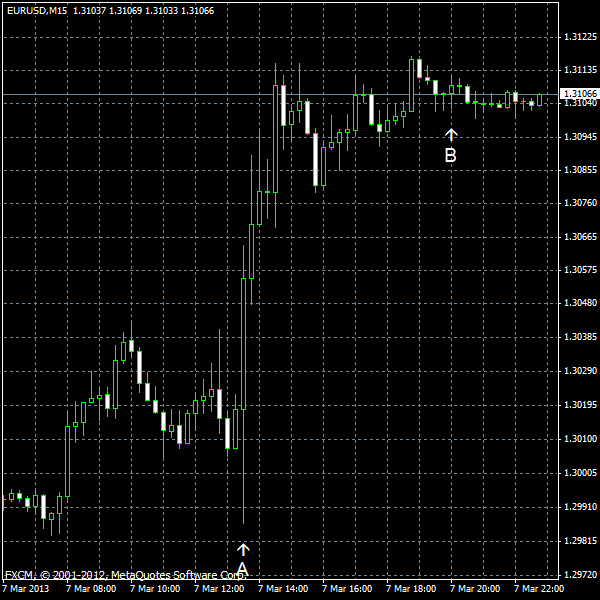

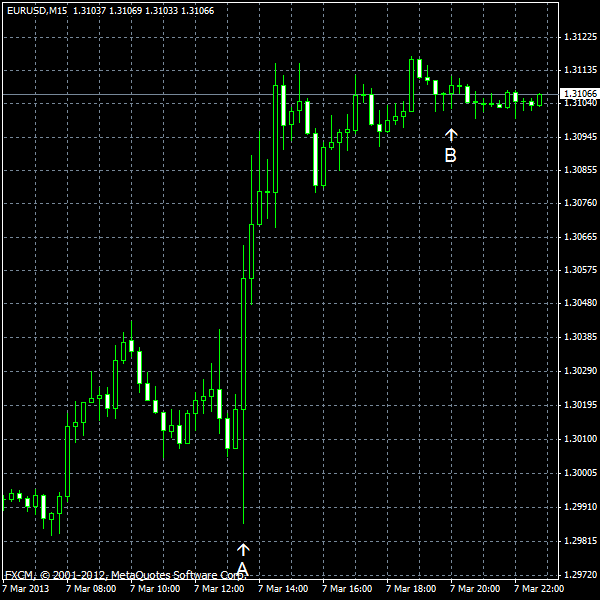

EUR/USD jumped today after the European Central Bank left interest rates unchanged and said that “economic activity should start stabilising in the first part of the year”. (Event A on the chart.) On top of that, Spanish bond yields were falling, suggesting that investors are confident in European assets. The positive data from the United States added to the good mood of traders.

US trade balance deficit widened to $44.4 billion in January up from $38.1 billion in December. Somewhat smaller increase to $42.8 billion was expected by market analysts. (Event A on the chart.)

Initial jobless claims fell from 347k to 340k last week. This was a positive surprise as an increase to 354 was expected. (Event A on the chart.)

Nonfarm productivity declined 1.9% in the fourth quarter of 2012, almost with the same pace as in the third quarter (2.0%). This is compared to the forecast decline of 1.6%. (Event A on the chart.)

Consumer credit grew $16.1 billion in January from December. Forecasters have predicted that the rate of growth would be near the December reading of $15.1 billion. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.