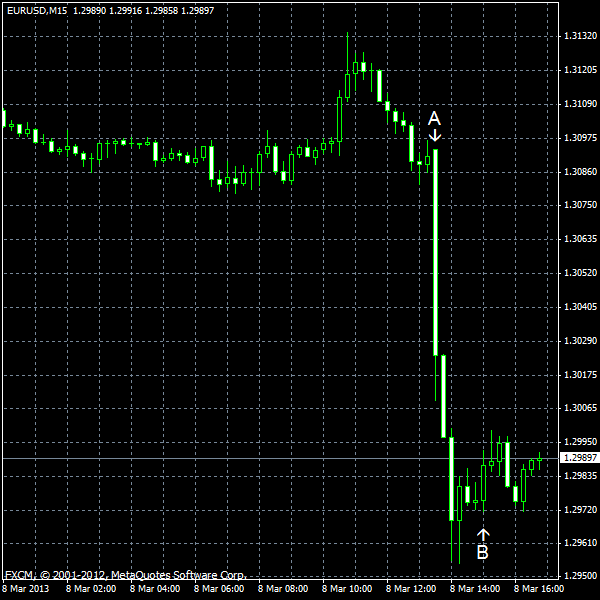

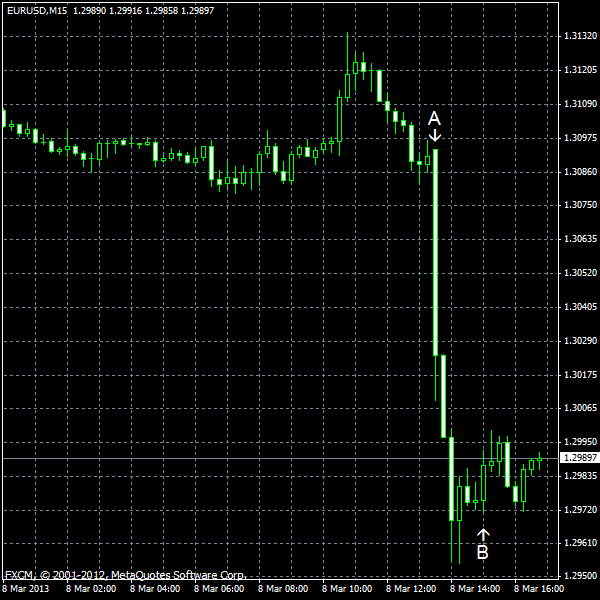

EUR/USD pared yesterday’s gains today after the US employment data came out much better than was expected. The US economy looks good, while the future of the European one still looks uncertain. Yesterday’s comments from the European Central Bank alleviated concerns only in a very short term and today traders again avoid the euro.

Nonfarm payrolls climbed 236k in February, beating forecasts of 162k by a large margin. The January increase was revised negatively from 157k to 119k. Nonfarm payrolls unexpectedly fell from 7.9% to 7.7%. (Event A on the chart.)

Wholesale inventories grew 1.2% in January, compared to the median analysts’ estimate of 0.4%. The December decrease of 0.1% was revised to the increase by the same rate. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.