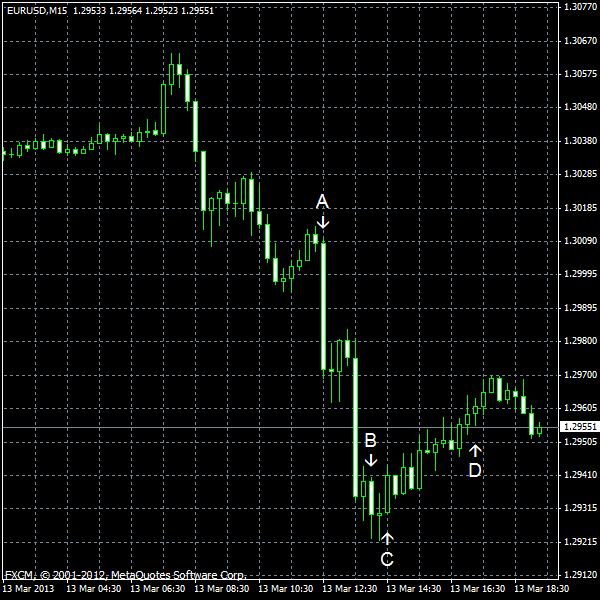

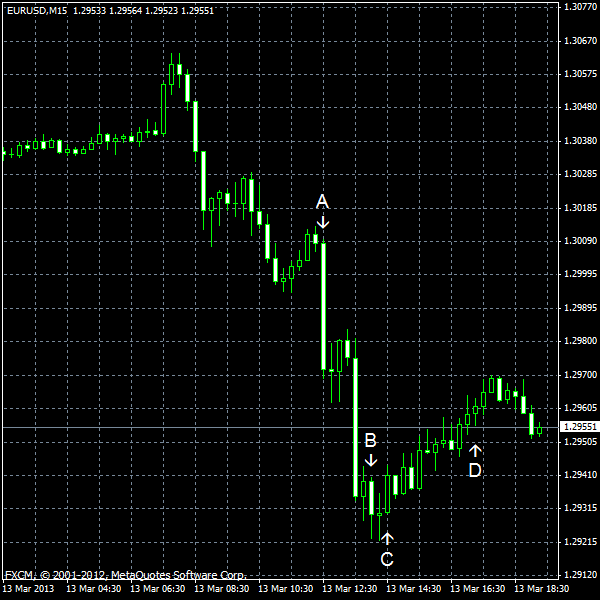

EUR/USD dropped after the Italian debt auction. Italy achieved its target, but the auction was viewed as a negative event by market participants because yields were rising. Most reports from the United States were good, but the federal budget balance posted a huge deficit in February after demonstrating a surplus in the prior month.

Retail sales rose 1.1% in February after increasing 0.2% in the preceding month. The projected growth was 0.5%. (Event A on the chart.)

Both import and export prices grew in February. Import prices ticked up 1.1%, while analysts have thought that the rate of growth would be near the previous month’s 0.6%. The increase was driven mainly by fuel prices. Export prices advanced 0.8% last month after rising 0.3% in January. (Event A on the chart.)

Business inventories increased 1.0% in January from December, when they expanded 0.3%. Experts have predicted 0.5% growth. (Event B on the chart.)

Crude oil inventories expanded by 2.6 million barrels last week, in line with forecasts, and are well above the upper limit of the average range for this time of year. Total motor gasoline inventories shrank by 3.6 million barrels, remaining in the middle of the average range. (Event C on the chart.)

Treasury budget posted a deficit of $203.5 billion in February, matching forecasts. The budged had a surplus of $2.9 billion in January. (Event D on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.