- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: March 14, 2013

March 14

March 142013

Swiss Franc Strong Even as SNB Maintains Ceiling

The Swiss franc jumped today even after the Swiss National Bank maintained the cap on the currency and signaled that the exchange rate is still high. The SNB left interest rates near zero and the ceiling at 1.20 francs per euro today. The central bank said that the currency “is still high”. The bank also revised its inflation projections to -0.2 percent for 2013 and 0.2 percent for 2014, down from -0.1 for this […]

Read more March 14

March 142013

Norges Bank Sees No Interest Rate Increase Until 2014

The Norwegian krone weakened today after the central bank left interest rates stable and signaled that no change to the monetary policy is expected until the next year. Norges Bank left its key interest rate at 1.5 percent today. Governor Oeystein Olsen said that Norway’s economic growth and inflation “have been slightly lower than projected”. The central bank stated: The key policy rate is low […]

Read more March 14

March 142013

UK Pound Sees Some Gains

UK pound’s recent sell off seems to be over — for now. Sterling is seeing some success today, helped by positional factors, as well as by a general feeling of risk appetite in the markets. Today, UK pound is making a mostly strong showing today against its major counterparts. Risk appetite is helping a bit. Equities, by and large, are rallying today. Even though gains by major indices have been somewhat […]

Read more March 14

March 142013

Better Economic Data Boosts Loonie

Better news in the United States and in Canada is helping the loonie today. Between unexpectedly low jobless claims in the United States, and higher housing prices in Canada, plus events around the world resulting in risk-on sentiment today, the loonie is heading mostly higher today. Canadian dollar is up against most of its trading counterparts today, thanks in large part to improved sentiment around the world. The latest initial jobless claims […]

Read more March 14

March 142013

RBNZ Does Not Anticipate Higher Interest Rates This Year

The New Zealand dollar rose today after yesterday’s drop, but gains were limited after the central bank said that an interest rate hike is not likely to happen this year. The kiwi was trying to follow its Australian counterpart in gains, but it was hard to do after the Reserve Bank of New Zealand signaled that it puts interest rates on hold. The RBNZ kept its key […]

Read more March 14

March 142013

Good Employment Makes Australian Dollar Stronger

The Australian dollar climbed today after the employment data came out much better than was predicted by analysts, reducing bets on an interest rate cut by the central bank. Australian employers added 71,500 jobs in February. This is compared to the consensus forecast of 9,500. The unemployment rate remained steady at 5.4 percent. Market participants have feared that it would go up by 0.1 percentage point. AUD/USD went up […]

Read more March 14

March 142013

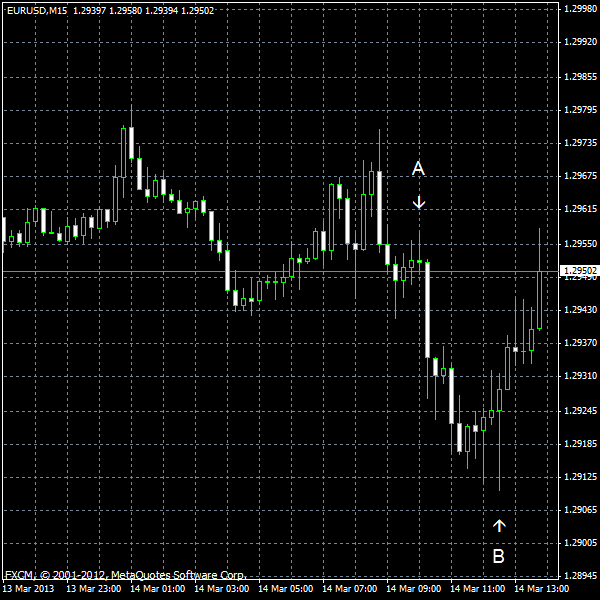

EUR/USD Drops for Third Session as Eurozone Employment Falls

EUR/USD continued to be weak and extended its decline for the third straight session today. Eurozone employment dropped 0.3% in the fourth quarter of the last year, giving yet another evidence that the European economy is still fragile. (Event A on the chart.) The data from the United States, on the other hand, was rather positive, including unemployment claims, which unexpectedly fell last week. PPI rose 0.7% in February, matching analysts’ forecasts […]

Read more