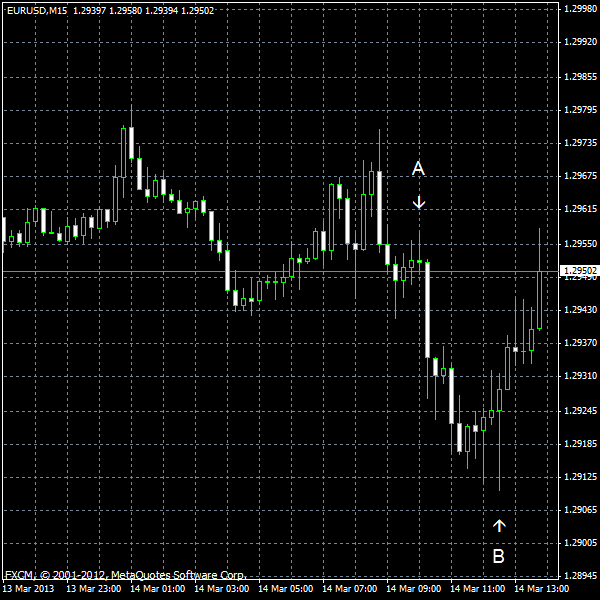

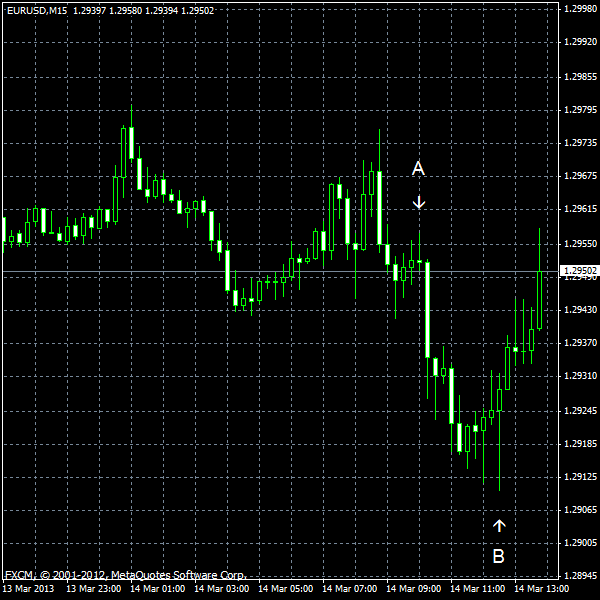

EUR/USD continued to be weak and extended its decline for the third straight session today. Eurozone employment dropped 0.3% in the fourth quarter of the last year, giving yet another evidence that the European economy is still fragile. (Event A on the chart.) The data from the United States, on the other hand, was rather positive, including unemployment claims, which unexpectedly fell last week.

PPI rose 0.7% in February, matching analysts’ forecasts exactly, after increasing 0.2% in the preceding month. (Event B on the chart.)

Initial jobless claims fell from 342k to 332k last week. Market participants have anticipated an increase to 348k. (Event B on the chart.)

Current account deficit was little changed to $110.4 billion (preliminary) in the fourth quarter of 2012 from $112.4 billion (revised) in the third quarter, being in line with forecasts. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.