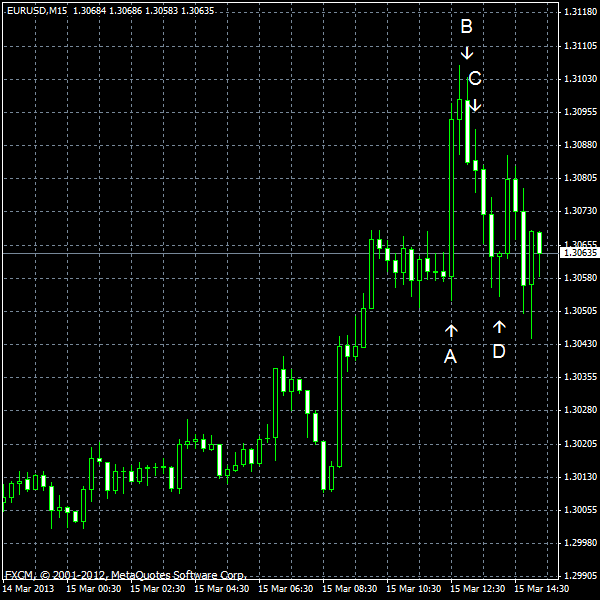

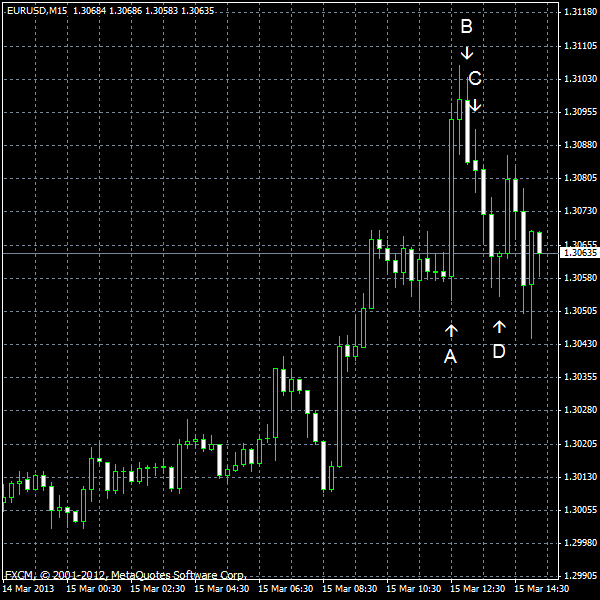

EUR/USD rose today for the second day (it reversed yesterday’s losses by the end of the trading session) ahead of next week’s Federal Reserve policy meeting. Forex market participants anticipate the Fed to maintain stimulus and such expectations drove the US currency down. Today’s data from the United States was mixed, with both good (CPI and industrial production) and bad (manufacturing and consumer confidence) indicators.

CPI rose 0.7% in February, a bit more that the analysts’ projection of 0.6%. The index registered no change in January. (Event A on the chart.)

NY Empire State Index was at 9.2 in March, below the February’s 10.0. The consensus forecast was 9.8. (Event A on the chart.)

Net foreign purchases fell from $64.2 billion in December to $25.7 billion in January. Analysts have hoped that the decrease would be smaller, to $39.3 billion. (Event B on the chart.)

Industrial production and capacity utilization grew in February. Industrial production expanded 0.7%, beating the prediction of 0.4%. The January reading was revised positively from -0.1% to 0.0%. Utilization rate increased from 79.2% to 79.6%, compared to the forecast of 79.4%. (Event C on the chart.)

According to the preliminary report, Michigan Sentiment Index dipped from 77.6 in February (revised positively from 76.3) to 71.8 in March, frustrating market participants who have expected an increase to 78.2. (Event D on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.