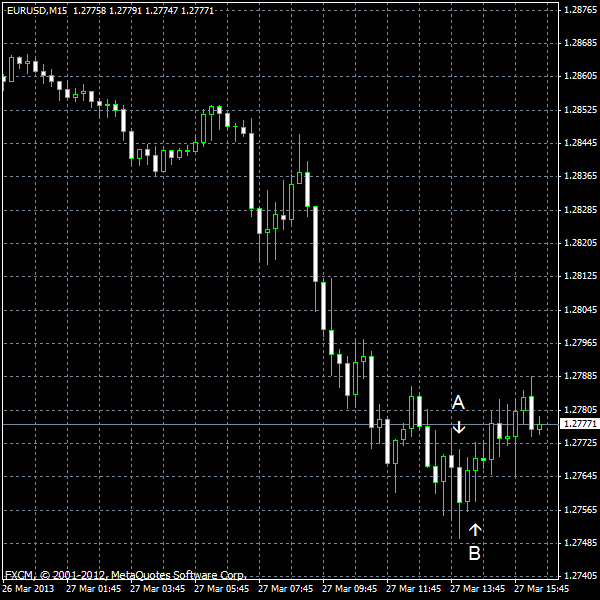

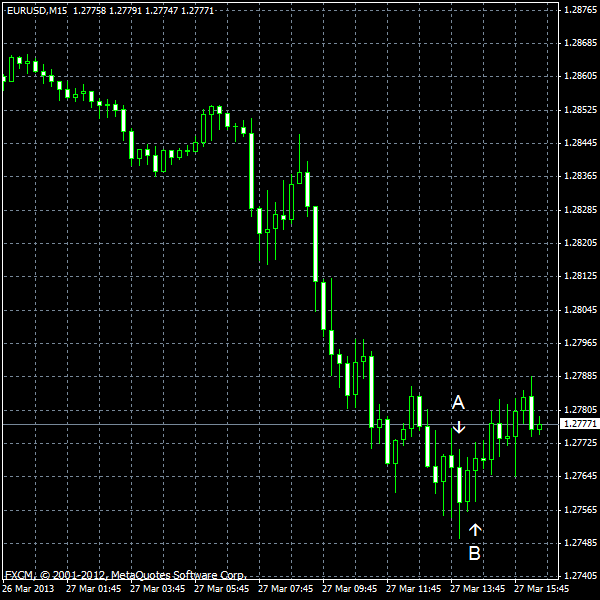

EUR/USD recovered yesterday after the initial loss, but returned to a free fall today. Italy is unable to form a coalition government, adding to worries caused by the situation in Cyprus. This day was not particularly interesting in terms of data from the United States. Tomorrow, the last revision of the fourth quarter gross domestic product will be released and this report might make a strong impact on the Forex market.

Pending home sales dipped 0.4% in February from a month ago. Market participants were not dismayed by the report as they were expecting a drop by 0.3% anyway. The downward revision of the January increase (from 4.5% to 3.8%) was more depressing though. The falling sales were attributed to dwindling inventories, which limited buyers’ choice. (Event A on the chart.)

Crude oil inventories increased by 3.3 million barrels last week, about two time the forecast of 1.5 million. Reserves are well above the upper limit of the average range for this time of year. Total motor gasoline inventories decreased by 1.6 million barrels but remained in the middle of the average range. (Event B on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.