EUR/USD ended its rally today after five days of gains. The currency pair attempted to rally on this trading session too, but failed. The minutes of the last Fed’s meeting was released ahead of schedule, but did not reveal anything particularly new. The macroeconomic data from the United States was good, while traders are still nervous about the economic health of the eurozone.

The Federal Open Market Committee minutes, which were released today earlier than usual, confirmed that there are hawks among the Federal Reserve board who believe that quantitative easing should be scaled down by the

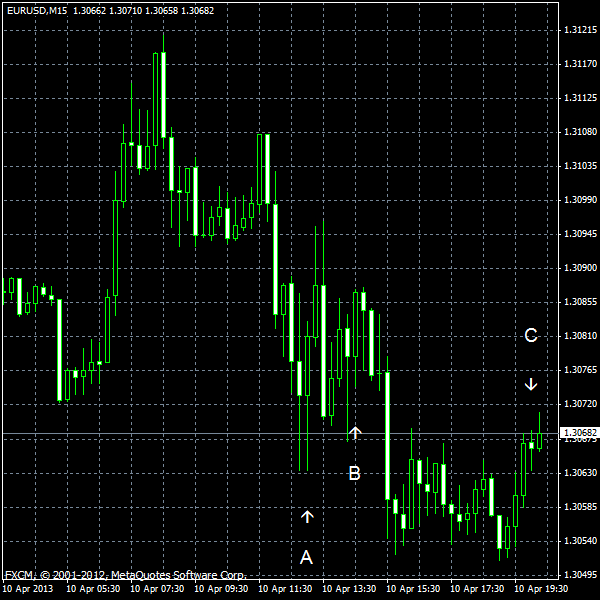

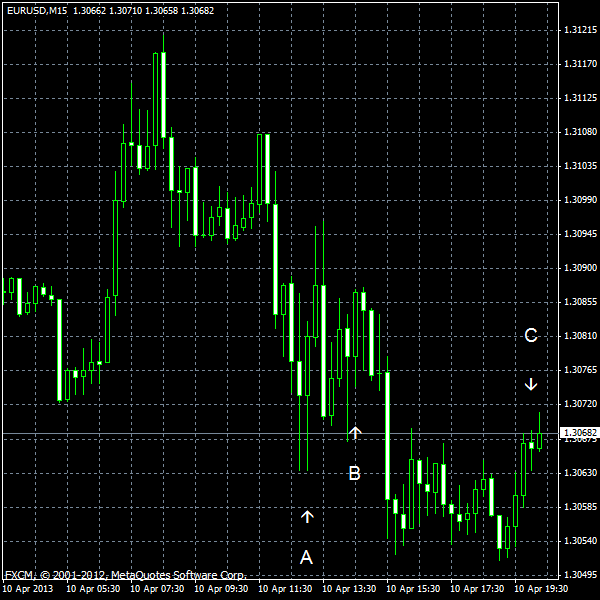

Crude oil inventories rose by just 0.3 million barrels last week (compared to the forecast of 1.6 million and the previous increase of 2.7 million) and are well above the upper limit of the average range for this time of year. Total motor gasoline inventories increased by 1.7 million barrels and are at the upper limit of the average range. (Event B on the chart.)

Treasury budget deficit narrowed from $203.5 billion in February to $106.5 billion in March. The actual value was close the expected $110.3 billion. (Event C on the chart.)

Yesterday, a report on wholesale inventories was released, showing a drop by 0.3% in February. Forecasters promised a 0.5% increase. The January growth was revised from 1.2% to 0.8%. (Not shown on the chart.)

If you have any comments on the recent EUR/USD action, please reply using the form below.