In my opinion, Ichimoku Kinko Hyo is one of the most underused technical indicators (4th least popular Forex indicator out of 13 in this poll). Yet it seems to be rather powerful and its usage is not that complex after you get some basic understanding of its five components.

After studying some trading strategies based on Ichimoku, I have tried to create a profitable trading robot that would be based on this indicator. The resulting expert advisor is using only three lines for entry and exit signals — Chikou (which is a current Close shifted backwards), Senkou Span A and Senkou Span B (which together form Kumo cloud). The strategy is to buy when Chikou crosses Close from below with confirmation coming from Kumo. Cross should happen above Kumo or Chikou should eventually come above Kumo, and the current price should close above Kumo. Sell signals are the same but mirrored. There is no

In addition to Ichimoku Kinko Hyo, this EA relies also on Average True Range indicator to size its positions. Of course, plain fixed position sizes are available too, but the

The

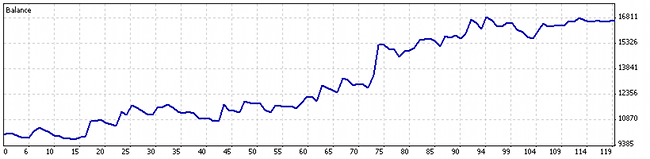

As you can see, the balance curve is not very impressive. ~67% over more than 12 years is not a very good result. That was with the fixed position size (0.1 lot). Now, the same test but with

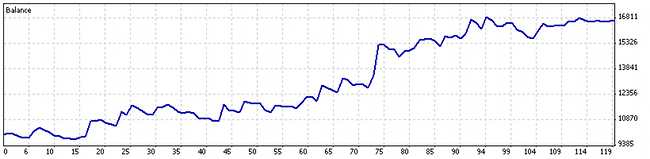

The net profit looks much better now, doesn’t it? ~238% over 12 years is something worth accomplishing.

Still many traders might think — why bother with such a slow and

You can download the MT4 or MT5 version, or read more info about this Ichimoku expert advisor. Ichimoku Chikou Cross is also available for cTrader. Unfortunately, unlike MetaTrader versions, it does not support ATR position sizing due to the lack of proper symbol information functions.

If you have any questions or some interesting thoughts regarding the more info, please feel free to post them using the form below.