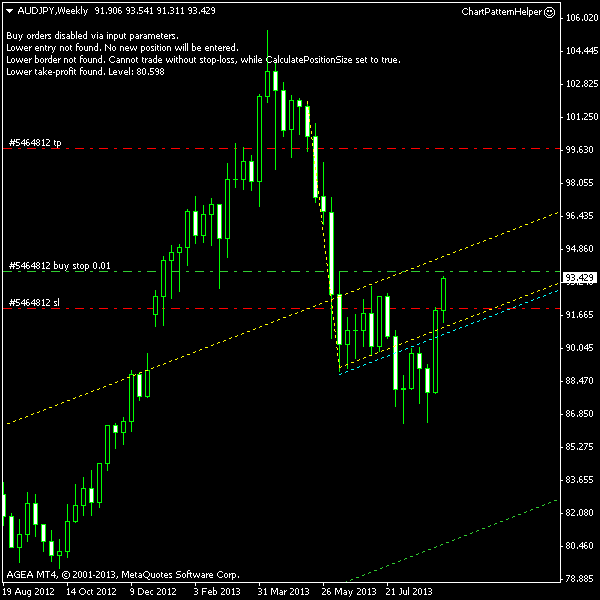

It looks like a bearish flag pattern has almost formed on AUD/JPY chart. Although it looks like one, the consolidation part may be considered too short for a complete flag figure — only 4 bars. Then, 4 bars is nearly one month on a weekly chart, so the price is stabilizing for quite some time now.

The flag’s pole is rather long (single yellow line), starting in early May. Consolidation phase has been entered in

You can download my MetaTrader 4 chart template for this AUD/JPY pattern. It can be traded using my free Chart Pattern Helper EA.

Update 2013-07-22 04:39 GMT: Short position triggered at 17:55 GMT yesterday. The entry price is 89.841,

Update 2013-09-10 04:25 GMT: Closed at

If you have any questions or comments regarding this bearish flag on AUD/JPY chart, please feel free to submit them via the form below.