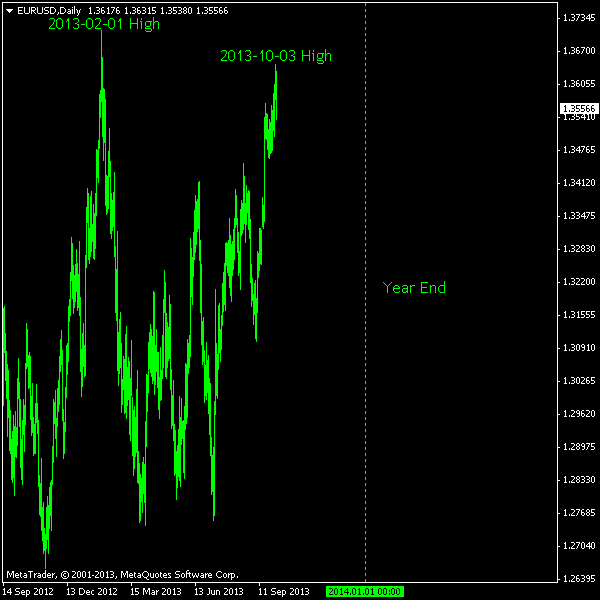

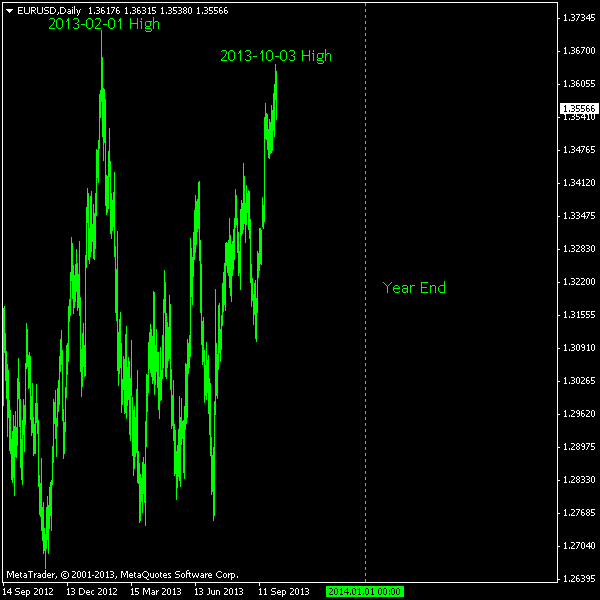

After hitting its 2013 high of 1.3710 on February 1, the EUR/USD currency pair proceeded to trade in a sort of a widening sideways market. It then evolved into a rather strong rally, which lasts since July 10. Spurred by Fed’s reluctance to tamper its quantitative easing program, the currency rate is now quite close to its yearly high. October 3 peak at 1.3646 is just 64 pips below the maximum.

Rising to a new record level for the year would mean a return of EUR/USD to its late 2011 levels. It would not put this FX pair into any sort of

Will EUR/USD break its 2013 high of 1.3710 before the end of the year?

- Yes. (59%, 10 Votes)

- No. (35%, 6 Votes)

- Not sure. (6%, 1 Votes)

Total Voters: 17

![]() Loading …

Loading …

The poll will expire on December 1.

By the way: Binary.com is currently valuing the options contract for the event of EUR/USD hitting 1.3710 by the end of 2013 at $82.02 (for $100 return), which means that the binary options brokers believe in a higher probability for the new maximum this year.

Update 2013-10-22: I have closed the poll as the price has broken through 1.3710 and set a new yearly high at 1.3785. Those who voted “no” should blame delayed fundamental reports.

If you wish to offer some detailed forecast on how EUR/USD will trade by the end of 2013, please feel free to submit it using the commentary form below.