Earlier this year I have asked about interest rates. I have incorrectly used the term QE — I should have been talking about the two events separately: removing purchase of

Before proceeding to some necessary introduction of the fundamental background for the topic of this poll, I would like to offer a small justification for creation of this poll. Although they say that the majority of traders is always wrong in their economic forecasts, the audience of this blog has proven that it is capable of outguessing the markets at least sometimes. As my latest EUR/USD poll (and the one from 2012) and EUR/CHF poll show, it can be a good idea to pay attention to such collective forecasts.

When the Federal Reserve lowered its interest rate to 0–0.25% range in December 2008, they did it to provide financial institutions with exceptionally high level of liquidity. The measure was reinforced with quantitative easing (Fed buying US treasuries and mortgage derivatives), which began even earlier — in November 2008. The second round of QE was launched in November 2010 and the third one in September 2012. Apparently, there would be nothing new in QE3 trimming as the Fed had already done that before.

Both interest rate reduction and quantitative easing program have been introduced by Ben Bernanke — the Fed Chairman, whose term is ending on January 31, 2014. Most likely, he will be succeeded by Jannet Yellen — a Fed Board member known for her very dovish statements. Many market participants are concerned that she will not conduct any QE tapering and might even increase the scale of the Fed’s purchases.

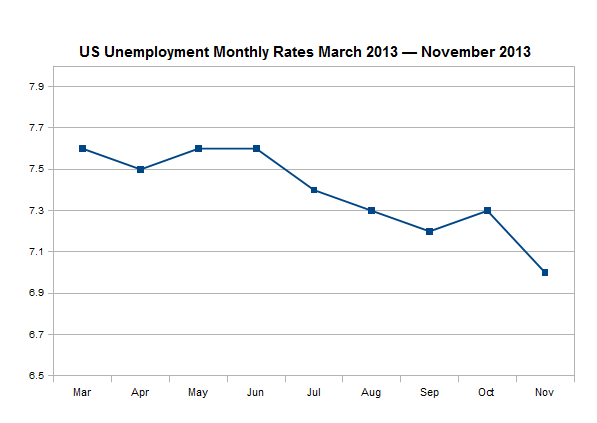

Yellen emphasizes unemployment rate as one of the most important indicators of the economic health. In my opinion, it is prudent to assume that as long as the jobless rate will be falling, the new Fed Governor will continue with the policy of QE reduction. You can see the chart of the latest developments in unemployment situation below. The data shows a clear downtrend in unemployment rate, meaning that there will probably no objective reasons for Yellen not to continue tapering in 2014.

(Please, also see the previous chart showing data through February 2013.)

But even if we assume that she will be willing to taper, how far will she be ready to go? And how far will she be able to go? Although, Bernanke is still the official head of the Fed until January 31, many observers believe that Yellen will lead the first FOMC meeting of 2014 on January 28–29. It is highly likely that she will have all 8 meetings of the next year at her disposal. If she cuts $5 billion per asset class ($10 billion total) per meeting, the QE will be down to zero by the year’s end.

Of course, there could be a new wave of crisis that could possibly prevent the new Fed Chairwoman from reducing stimulus. It also may turn out that Yellen will not choose to continue her predecessor’s way of tapering either slowing it down significantly or increasing the spending above current level.

Will Janet Yellen stop Fed’s “asset purchases” in 2014?

- Yes, QE3 will end in 2014. (40%, 6 Votes)

- No, there will be no change to the current rate of purchases. (20%, 3 Votes)

- No, but there will be a moderate QE3 tapering. (20%, 3 Votes)

- No, the rate of purchases will only grow under Yellen. (13%, 2 Votes)

- Yes. Moreover, Yellen will initiate the sale of Fed’s assets purchased as a part of QE3. (7%, 1 Votes)

- No, but the Fed’s monthly pace of purchases will at least halve. (0%, 0 Votes)

Total Voters: 15

![]() Loading …

Loading …

If you have some interesting opinion regarding Janet Yellen and her ideas of monetary policy, please feel free to share them using the commentary form below.