- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: February 6, 2014

February 6

February 62014

Canadian Dollar Shows Mixed Performance Ahead of Tomorrow’s Data

The Canadian dollar rose against the US dollar and the Japanese yen, but fell versus the euro today. Macroeconomic data from Canada was mixed today, while specialists expect that tomorrow’s employment report should be very good. Canada’s trade deficit unexpectedly widened from $1.5 billion in November to $1.7 billion in December. The Purchasing Managers’ Index of Richard Ivey School of Business climbed from 46.3 in December to 56.8 […]

Read more February 6

February 62014

Yen Shows Weakness as Central Banks Do Not Surprise

The Japanese yen was soft today as two major central banks did not provide surprises and left their monetary policies unchanged. Absence of any shocking events made Forex traders feel more secure and reduced need for the safety of the yen, but the upheaval on Wall Street may yet return demand for the Japanese currency. Some market analysts were thinking that the European Central Bank would cut interest rates […]

Read more February 6

February 62014

Dollar Index Lower For Now, But Support May Come

The US dollar index is lower for now, but more support for the greenback might be in the future. For now, the dollar is lower against the euro, as well as the yen, but it could find support if the economic situations in the eurozone and the United Kingdom don’t improve anytime soon. Right now, the US dollar is lower, following the news that the ECB and BOE aren’t planning on adjusting interest rate policy — at least not […]

Read more February 6

February 62014

Euro Sees Gains Following ECB Decision

The latest ECB decision is providing a bit of confidence for the euro, resulting in gains for the 18-nation currency. However, the gains might be short-lived, depending on what ECB President Mario Draghi has to say about the future of the eurozone’s monetary policy. The euro is recovering from some of its earlier losses today, thanks to the fact that the European Central Bank decided not to take action and cut rates. Many had thought that […]

Read more February 6

February 62014

Bank of England Makes No Move Regarding Monetary Policy, Sterling Flat

The Great Britain pound traded sideways today, and the Bank of England provided the currency little help in finding direction as it has left the monetary policy unchanged, in line with traders’ expectations. The BoE announced today:â The Bank of Englandâs Monetary Policy Committee today voted to maintain Bank Rate at 0.5%. The Committee also voted to maintain the stock of purchased assets financed by the issuance of central bank reserves at £375 billion. Market participants expected […]

Read more February 6

February 62014

Unexpected Trade Surplus Makes Aussie Stronger

The Australian dollar advanced today as the nation’s trade balance posted an unexpected surplus in December. Reports about retail sales and business confidence were also good, adding to the strength of the currency. Australia’s trade surplus widened from A$83 million to A$468 million in December, while analysts have predicted a deficit of A$270 million. Retail sales grew 0.5 percent in December from November. The National Australia Bank business confidence index rose […]

Read more February 6

February 62014

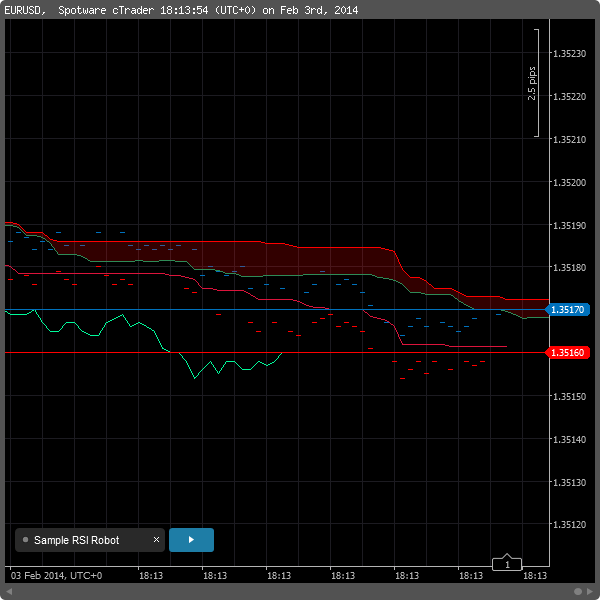

cTrader’s Innovation Goes Beyond MetaTrader

Half a year has passed since my last overview of the new features in a cTrader platform. Spotware continued to nourish its child, and now cTrader provides something that MetaTrader (all versions) still lack — normal tick charts. cTrader tick charts fully support indicators, chart objects and even expert advisors (robots). In addition to traditional 1-tick charts, a trader may choose to switch to aggregated tick charts (from 2 to 10, […]

Read more February 6

February 62014

ECB Avoids Interest Rate Cut, EUR/USD Shows Solid Rally

EUR/USD rallied today after the European Central Bank refrained from cutting interest rates. (Event A on the chart.) President Mario Draghi was not particularly dovish at the press-conference that followed the policy announcement, calming fears and returning appeal to the European currency. (Event B on the chart.) Meanwhile, the US trade balance was disappointing, while unemployment claims surprised positively. US trade balance posted a deficit of $38.7 billion in December, up […]

Read more