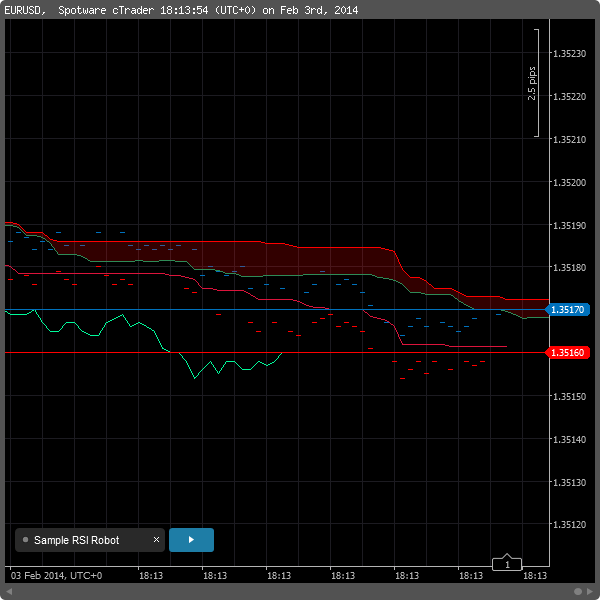

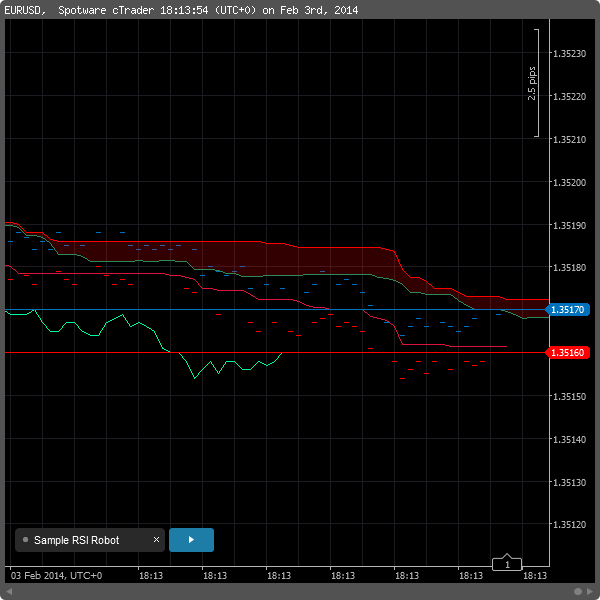

Half a year has passed since my last overview of the new features in a cTrader platform. Spotware continued to nourish its child, and now cTrader provides something that MetaTrader (all versions) still lack — normal tick charts.

cTrader tick charts fully support indicators, chart objects and even expert advisors (robots). In addition to traditional 1-tick charts, a trader may choose to switch to aggregated tick charts (from 2 to 10, 13, 21, 34 and 55 ticks).

Other important changes to the trading platform include:

As you can see, cTrader gradually goes away from being a kind of MetaTrader replica and becomes even better in such important aspects as chart types. While MetaQuotes Software is more concerned with reaping commissions from its market and jobs services, Spotware is preoccupied with conquering its market share, which results in such nice features as those listed above.

If you have want to share some comments regarding what you like or dislike in cTrader, please feel free to post them using the commentary form below.