I had been looking at the expert advisors list presented on EarnForex.com and decided it was a good time to refresh the backtests for many of them. Some of those backtests were 6 years old. Of course, something should have changed in the markets since 2007. It is important to retest and reanalyze your strategies from time to time to see if they are still working or if they have just got lucky during the old backtest.

Below, I present the new backtest results of the 14 MetaTrader expert advisors that had old testing data listed.

Adjustable MA

This basic moving average cross EA turned out to be a

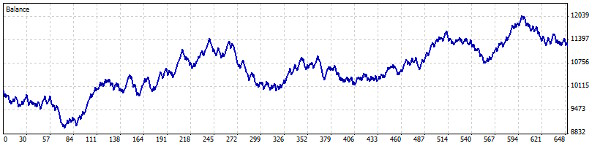

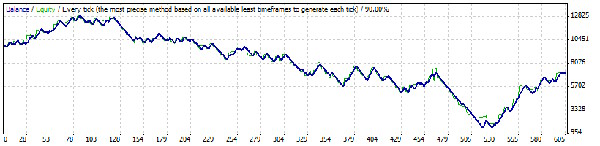

Adjustable MA 3G

Surprisingly, the advanced version of the same basic moving average cross EA retained its profitability. During my previous backtests, it has shown improved results compared to the common Adjustable MA. Going from 1-year test to 6 years increased the overall profit from 26.2% to 416%, while the maximum drawdown rose from 4.3% to just 10%. It looks like applying the 3rd generation moving average indicator really gives an edge over the market.

Artificial Intelligence

Like many other of the tested expert advisors, Artificial Intelligence has turned to a complete loss. It bankrupted the account during the first three years of the backtest. It is also worth mentioning that its input parameters are meant to be optimized on a regular basis, so probably it is not that bad after all, but nevertheless I do not think that this robot is a good choice to run in your live account.

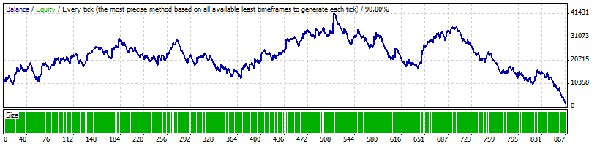

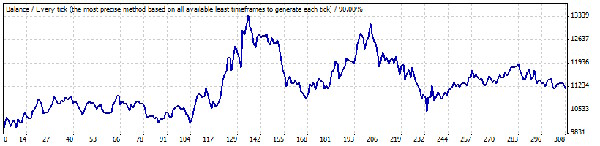

AUD/JPY Wednesday 15:00

From being the second best EA in the list, this one degraded to nothing more than a total loser. It looks like its previous success was dictated not by the intrinsic behavior of the AUD/JPY currency pair but rather by a quirk of luck. The balance curve speaks for itself:

Binario

Although Binario failed to demonstrate a proportional increase of profitability with an extended backtesting period, this EA still shows some stability in its results. Nevertheless, it is a rather poor choice of expert advisor when it comes to live FX trading — 63% profit vs. 57% drawdown on a period of more than 7 years is not something most traders would like to experience.

Framework

Framework is another example of a decent expert advisor falling to a

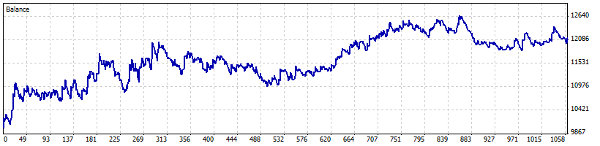

MACD Pattern

The renewed backtesting results of this expert advisor are not that bad. Some traders might actually call them good: 113% profit in 7 years with 29% maximum drawdown. The problem is that its profit peaked during the first 2 years of the test and then slowly deteriorated during the remaining 5 years. Would you want to see such returns on your real money investment?

MACD Sample

If you keep remembering that MACD Sample is nothing more than an

myFXOverEasy

This yet another

myPickyBreakout

After showing two really great profit peaks on its balance curve, myPickyBreakout ended backtesting with a rather poor result — 12% profit (in 7 years!) and 24% maximum relative drawdown. I guess there is no need to explain that this EA is now a wrong choice for any serious trader.

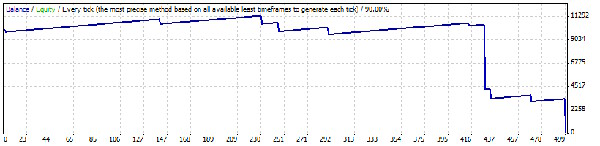

myRandom

I hope no one had taken this EA seriously and never used it on a live account. I am not even sure that there is any point in backtesting a random expert advisor, after all the results will also be quite random. Nevertheless, I decided to retest this robot too and the results were bad:

Otkat

Like some other EAs of this group, Otkat has failed at the end of the second year of backtesting. It did not literally lose all; it just went down to a point where it could not take any new trades.

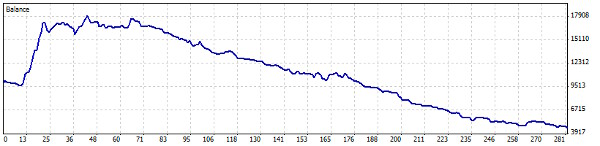

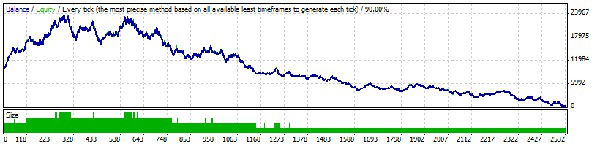

Phoenix

According to the latest backtesting results, Phoenix burned to ashes instead of rising from them similarly to its namesake mythical bird. It went from $10,000 to $0 in five long years, showing some success during the first two years but failing miserably during the last three.

ATR Trailer

Unlike other EAs, ATR Trailer already had rather recent testing results. Nevertheless, I have decided to retest it too and obtained satisfactory results. I have also decided not to renew the results on its description page as I consider the

The EA table and ratings have been adjusted to reflect these changes in backtest results. It should now be easier to choose a better expert advisor. Of course, this blog post should serve everyone as a reminder of the shifting nature of the foreign exchange market and that past performance can in no way guarantee any future results.

If you have any questions or comments about latest backtests of some of our expert advisors list, please feel free to post them using the form below.