I am a fan of

Even though the strategy may sound very simple, there are several ways to implement it and many nuances to consider while doing so. Should it use

After doing some backtests on major currency pairs, I have come to the conclusion that the best way would be to keep it as simple as possible, adding only a straightforward

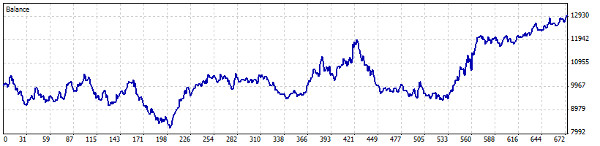

The Weekly Breakout EA failed to show good results on many of the major currency pairs, but it produced some nice gains on the following three pairs:

GBP/USD

USD/CHF

USD/JPY

An entrepreneurial trader can try to enhance this expert advisor even more. There are still some untested opportunities: introduce some filters based on the weekly candle’s size, apply buffer zone for breakouts, add some candlestick pattern analysis to increase accuracy, keep positions open for more than one week, etc.

If you have any questions or comments regarding the Weekly Breakout EA for MetaTrader, please feel free to post them using the form below.