Divergence between the price chart and the corresponding oscillator indicator levels is a

Here is an example of a bullish divergence signal. The price shows a new lower low, but the CCI indicator fails to show a lower low, signaling a probable reversal of the current bearish trend:

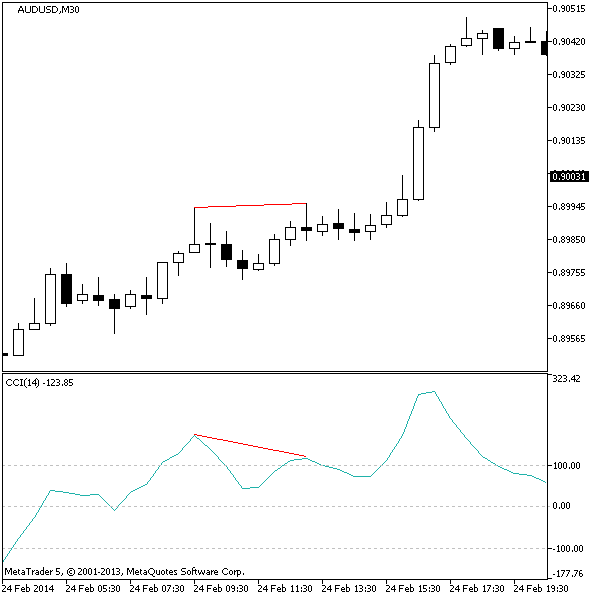

And here is an opposite signal — a bearish divergence. It appears inside an uptrend when the price posts a new higher high, while CCI displays a lower high. Notably, this particular signal is a loser as can be clearly seen from the ensuing price action:

Although the concept of divergence trading sounds very simple, there many nuances both in detection of the signals and in usage of these signals. You can refer to my own basic MACD strategy as a one example of what can be done with divergence.

Several technical indicators can be used to trade divergences: Moving Average Convergence/Divergence (MACD), Bill Williams’ Awesome Oscillator, Relative Strength Index (RSI), Commodity Channel Index (CCI), DeMarker, Stochastic Oscillator, etc. The main condition for the indicator to be capable of showing divergences is its

What is important to remember no matter which indicator you choose for divergence trading — not every divergence is a valid signal. Only sell on bearish divergence when it appears within an established uptrend, and buy on a bullish divergence only when it appears within a clear downtrend.

There are existing divergence indicators that help detect divergences automatically:

Disclaimer: these indicators were not developed by me.

Personally I find it difficult to spot “real” divergences with such automated indicators, whereas the signals themselves are also often unreliable. A test of RSI divergence trading performed by Thomas Bulkowski in stocks market showed rather poor results. Even though I believe it is possible to develop a winning methodology to trade divergence in Forex, there will always be too much left to trader’s own discretion to deter a proper automation of divergence strategies.

![]() Loading …

Loading …

If you want to ask a question about divergence trading or if you want to share a detailed opinion on using various indicators for divergence trading, please feel free to use the form below.