You can find a newly published trading system on EarnForex.com today — CoT Report Trading Strategy. It is based on rigorous backtesting of 32 different trading methods that use various data from Commitments of Traders reports released by CFTC. According to the poll, about a half of you are using CoT reports in trading at least occasionally. The presented strategy offers an opportunity for trading based strictly on those reports. Below is the detailed description of the tools used, the backtesting process, and the results obtained.

Tools

In order to backtest anything related to the Commitments of Traders reports, it is necessary to have an expert advisor that can somehow get the data from the past history of the reports and use them to enter and exit positions. You can now download such an expert advisor for free. It is based on the an MQL5 class that reads all the fields from the

The expert advisor can potentially trade any strategy based on any data from the CoT reports, but currently it is programmed to test only 32 strategies.

The spreadsheet contains the exact entry and exit signals (including additional exit signals for some strategies) for both buy and sell sides of each of the test strategy. The following terms are used to formulate the strategies:

All changes are from comparison to the previous weekly CoT report.

Backtesting Results

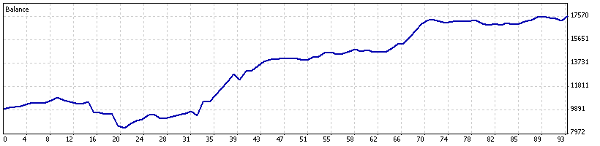

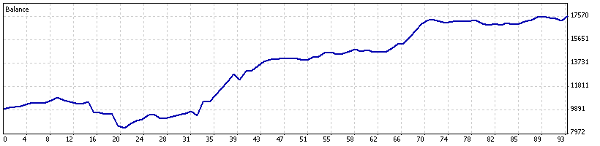

All tests were performed on a period from June 1, 2006, to February 7, 2014, on the following currency pairs: USD/CAD, USD/CHF, GBP/USD, USD/JPY, EUR/USD, AUD/USD and NZD/USD. A fixed position size of 0.1 standard lot was used.

The summary of the backtest results shows a table with total profit, maximum drawdown and number of trades for each tested strategy across each currency pair. The full set of all 224 backtesting reports with charts and a complete order history are also available for downloading.

The summary table reveals some interesting facts:

If you have any questions or suggestions for the strategy of using the CoT reports in Forex trading, please feel free to post them using the form below.