The influence of the US presidential cycles on the stock market is known for years. There are articles published in the

Classic Cycle

The article asserts that it pays off to hold long S&P500 position from October 1 of the second year of the US President term till December 31 of the fourth year. It is also profitable to short the market from January 1 of the first year through September 30 of the second year (remaining term). Such strategy, tested between the years 1950 and 2012, yields significantly more profit than the traditional

Naturally, it seems an interesting concept to test in relation to the currency market. My first step was to create an MT5 script that would long a currency pair according to the favorable conditions and short it during unfavorable conditions. As it is not obvious, which part of the presidential term is favorable for a given currency pair, a reverse option is available in the script. Without a reverse, it will long from October 1, second year, through December 31, fourth year. With a reverse, it will long from January 1, first year, through September 30, second year.

Unfortunately, the Forex test results did not show as much promise as those attained in equities. The test assumes a position of 1 standard lot. At first, it was used to go long with from October 1 of the second year of the presidential term through December 31 of the fourth year. EUR/USD chart data start on January 4, 1970 in my MetaTrader 5 (it is even worse for other currency pairs except USD/JPY). The result was the profit of $22,990, which is significantly lower than $79,920 that would have been attained if a plain

USD/JPY (another pair with history available from 1970) yielded similar results. Buying from October 1 of the second year through December 31 of the fourth year resulted in a loss of $81,298. Buying from January 1 of the first year through September 30 of the second year results in a loss of $97,902. The loss can be easily turned to profit by substituting long orders with short ones, but the resulting profit in both cases would be much lower than the classic

Results achieved in other currency pairs (GBP/USD, USD/CAD) are similar, but the historical data starts from the year 1993 there, so there was little sense in testing such a

The obvious conclusion is that the US presidential cycles do not work in Forex the same way they do in stocks. The growth cycle works for equities because of the way US Presidents apply economic policy during the course of their term. Currencies behave differently, but probably there is some other way president cycles could be applied to them?

Democrat/Republican Cycle

From my limited tests, it occurs that the currency pairs’ performance depends on the President’s political party. The US dollar demonstrates a tendency towards weakening during the rule of the Republican President, and it leans towards bullishness during the rule of the Democratic Presidents.

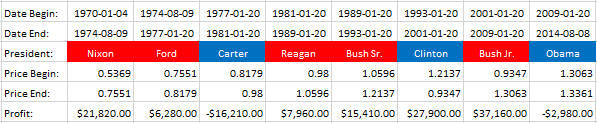

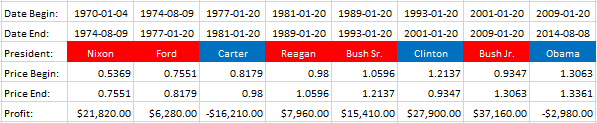

I have conducted another small test using another script that records gains (and losses) for holding a long position for Democrats and Republicans separately. Reversing the trade direction for Democrat Presidents results in a nice steady profitability with only few exceptions:

During the terms all of the Republican presidents, without exception, EUR/USD was rising. The currency pair was falling during Clinton’s term but was up during Carter’s. It is also up a little for Obama’s term, but everything can change until 2017. Nevertheless, the combined profit of going long on EUR/USD during Republicans and shorting the pair during Democrats yields $97,340 profit (position size of 1 standard lot) vs. $79,920 profit of

The test on USD/JPY showed that the pair declines during the terms of both Republicans and Democrats. It means that the correlation found in EUR/USD is not consistent across other currency pairs and should be used very cautiously. Moreover, there is really not enough data to come to a definite conclusion of profitability. I would not recommend betting your real money on the presidential cycle strategy, but it is still an interesting idea for further research.

If you have some comments about this small research or if you want to share your own ideas about trading Forex using US presidential cycles, please speak your mind using the commentary form below.