Quite often, I get requests from Forex traders to implement this or that indicator or expert advisor that applies tick volume to analyze or trade currency pair. Tick volume that is present in every MetaTrader platform is based on the number of price updates (ticks) that come during the formation of a given bar. At first glance, it seems to be a good approximation of real volume, but in reality it is a poor substitute, which can only serve as a simulated measure of “something”.

First, the main idea of tick volume is flawed — one tick (price update) may be caused by either a small volume trade or a very big trade — it will not be accounted for in the tick volume, which will increase by one notch only. Moreover, big trades may happen within the current price spread, which will not generate a tick.

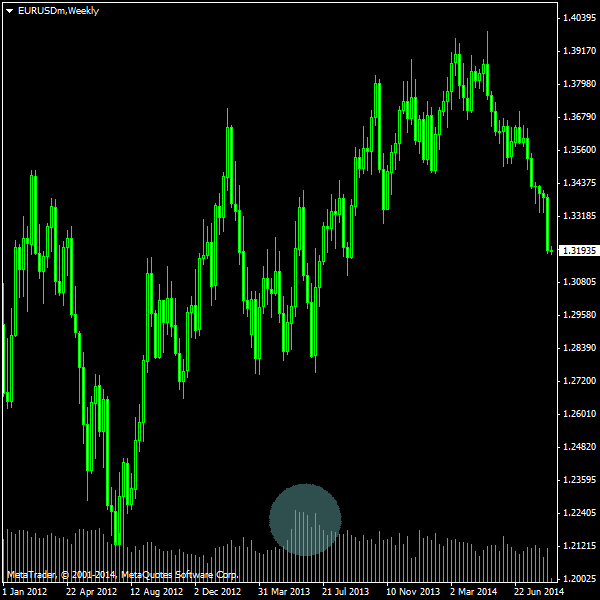

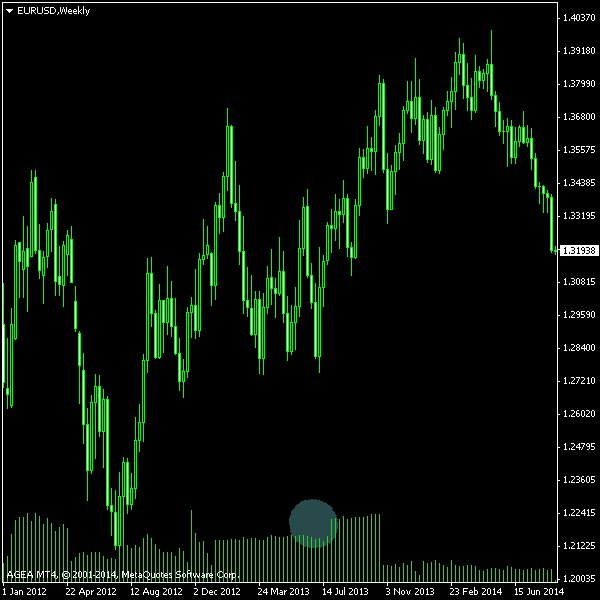

Second, the main contributing factor to the tick volume values is the broker’s data feed. Here are two screenshots that are worth more than two thousand words:

The top image is from EXNESS, the bottom image is from AGEA. Both images show weekly charts of EUR/USD with their respective tick volumes.

Third, tick volume does not correlate with real volume in futures market. Of course, there could not be a perfect correlation between spot and futures markets, but there should be at least some correlation between the two. Below is the

As you have probably understood by now, I do not believe that tick volume has any effective use in Forex trading. And how about you?

![]() Loading …

Loading …

If you want to share your opinion on how real trading volume can be estimated in spot foreign exchange market, please use the commentary form below.