The Russian ruble has made it to the new

EUR/RUB has rallied above 100 (at Ask price) before retracing back to 84.96.

There is a multitude of factors that influenced the Russian currency and pushed it down on Forex. The most important of them are listed below:

1. Oil — the biggest reason for the Ruble’s fall, actually. The prices for crude oil have been falling since

Brent crude oil went down from $112.18 to $58.51 per barrel during the same period:

Certainly, oil prices by themselves could not have caused such a disaster for the Russian currency, but they were one of the biggest snowballs that caused the avalanche.

2. Economic sanctions — first, they had been laughed at in Russia, then they had been ignored, then they have finally hit the country’s economy. The imposed limits on some of the biggest corporations prevented those companies from getting foreign financing and directed their demand to Russia’s internal loan and currency markets.

3. Conflict in Eastern Ukraine — the support of the separatist movement in the eastern part of Ukraine costs Russia dearly. Not only it is the cause for the Western sanctions but also a significant drain on resources, including the foreign currencies. Focusing on war rather than on the

4. Annexation of Crimea — the initial spark for the whole story of weakening ruble. It spurred the first strong bullish wave of USD/RUB this year when it rallied from 34.52 on February 7 to 36.77 on March 3. Similarly to Eastern Ukraine conflict, Crimea was a

5. External debt — Russian public and private sectors have to pay out a total of $30.2 billion in December. It is the biggest month in terms of payout this year. December’s payments can be compared to September’s payout of $24.3 billion when ruble lost almost 7% of its value during a month. As you can see, even December’s high payout value would not be enough to cause the turmoil of 10% daily drop seen today, but with foreign loans forbidden for many Russian companies, it definitely was among the main negative drivers for RUB.

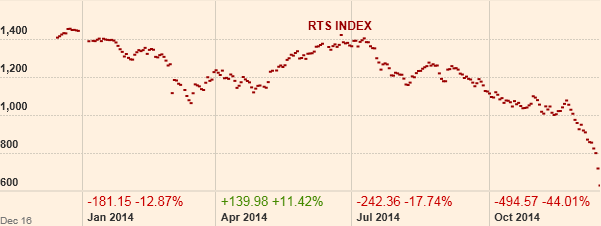

6. Plunging equities market — Russia’s RTS (USD denominated stock index) and MICEX (RUB denominated stock indexes) plunged during the whole Crimea/conflict/sanctions story. It is hard to determine, which was the cause and which was the consequence — the fall of stock prices or the fall of ruble. However, the simultaneous fall of both the stocks and the currency is a sure sign of a real economic crisis, which means that foreign investors have little incentive to return as of now.

7. Speculative trading — was the first thing to be blamed by the Russian officials. It looks like some of them are still living in the time of the good old USSR without even slightest understanding of how the free market work. However, it would be naive to claim that there were no speculative trades on Forex and that such trades did not add to the extent of the USD/RUB rally. Even I, personally, had my two lots working at it. I would be surprised if big investment banks had not jumped at this opportunity with their FX floors.

8. Panic — all of the

9. Central bank’s policy — was not very bright in this case. Russian Central Bank provided liquidity to some market participants at the cost of its foreign exchange reserves but failed to prevent some of the first big slumps of ruble. Its catastrophic post factum interest rate hikes only caused more stock market panic instead of acting as a support for the currency.

10. Imports — although Russia’s economy is based on oil and natural gas exports, the country is importing a lot of the goods it consumes, and it needs USD and EUR to buy those goods, which results in a great demand for the currencies. Even

11. Price for years of stability — ruble was very stable during the period after the global financial crisis of 2008. The stability had its price as it has been supported artificially by the central bank. Instead of allowing a gradual weakening of its currency, Russian authorities have been using the picture of a stable currency as a political tool. The eventual cost of doing so turned out to be surprisingly high.

12. Propaganda spending — annexation, undeclared war, economic downturn, and rigged regional elections would not be so easy for the Russian government to get away with if not for the unprecedented amount of propaganda used both internally and externally. Unfortunately for the ruble, the propaganda machine has its cost. While local TV and radio outlets can be funded with domestic currency, Russia Today and similar ventures had to be paid for in foreign currencies, driving demand for them up.

As of now, the rubble has managed to recover from its intraday high and USD/RUB is trading just above 67, but the questions about its future remain unanswered. Will Russia impose full capital control? Will the ruble fall even deeper if no trade limits are set? Is there any win/win way out of this situation for the country’s economy, its currency, and its credit rating?

Unfortunately, the answers to those questions now offer solely theoretical interest as many retail brokers have already switched USD/RUB and EUR/RUB trading to “close only” due to low liquidity. This means that traders can no longer engage in new trading positions on these currency pairs.

If there is something you wanted to share about your experience trading USD/RUB or EUR/RUB currency pairs, please post about it below.