- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: December 22, 2014

December 22

December 222014

Euro regains ground, but not for long

Euro is gaining a little ground today, heading higher thanks to some improved data, and better risk appetite. However, the euro’s new found gains are likely to be short lived, since the 18-nation currency remains on shaky ground. Better economic data is beginning to help the euro a little bit in currency trading on the FX market. However, the small gains made today aren’t expected to last. Many predict more […]

Read more December 22

December 222014

Taiwan Dollar Unable to Hold Ground vs. US Counterpart

The Taiwan dollar fell today on concerns that foreign investors will abandon local assets because of expectations of higher interest rates in the United States. Other currencies of emerging markets were also under pressure though some of them showed resilience. Prospects for monetary tightening from the Federal Reserve made the trading environment unfavorable for riskier currencies. While some of them, including the Indian rupee, were able to resist the pressure, the Taiwan […]

Read more December 22

December 222014

Indian Rupee Weakens on Fed Tightening Expectations, Recovers

The Indian rupee declined today on concerns that the planned interest rate hike from the Federal Reserve will deter investors from emerging markets. Yet the currency was able to recover as of now, suggesting that volatility on the market is rising after the Fed meeting and ahead of the holiday period. The outlook for monetary tightening from the Fed made the US dollar stronger. This, in turn, will likely reduce capital inflows from overseas […]

Read more December 22

December 222014

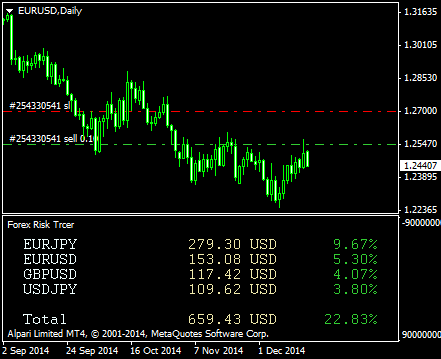

When More Risk Is Too Much in Forex?

According to one of my old polls, the majority of active FX traders prefers to risk no more than 5% of their balance on one trade. I personally, prefer my risk per trade to be near 1%-2%. But how should we, as traders, act when a new opportunity arises and we already have an open position with our risk limit hit? Should we use the opportunity and double our potential risk? How […]

Read more