According to one of my old polls, the majority of active FX traders prefers to risk no more than 5% of their balance on one trade. I personally, prefer my risk per trade to be near 1%-2%. But how should we, as traders, act when a new opportunity arises and we already have an open position with our risk limit hit? Should we use the opportunity and double our potential risk? How many positions should we tolerate with this logic? Should we treat positions on negatively correlated currency pairs differently from those we open for the same currency pair or for the currency pairs with high positive correlation?

Experienced traders usually define some portfolio risk, which they set as the maximum limit of risk per balance (or per equity) across all simultaneously open positions. The concept is pretty obvious, but it lacks the answer to the initial question. For example, if we define our per trade risk as 2% and portfolio risk as 10%, and then open 5 positions for 2% risk each we will stumble upon a dilemma when the next (6th) trading signal arrives. Should we skip it or should we open a new trade? If we open a trade, should we go full 2% on it or decrease the risk to 1%? Or should we partially close some of the earlier positions to arrive at 6 positions — all with the same risk?

I do not have a strict value of my own portfolio risk limit. For positions on the same currency pair, it is usually no more than 5%. For positions on several uncorrelated currency pairs, it can easily be as high as 30%. And how about you?

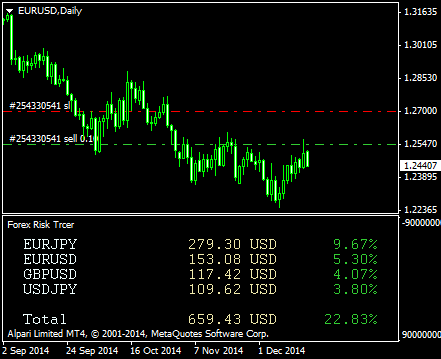

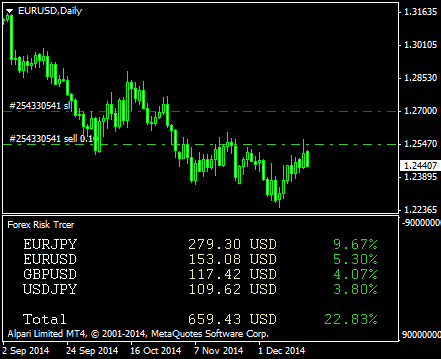

![]() Loading …

Loading …

If you have some interesting comments or questions on dealing with the total portfolio risk in Forex trading, please use the commentary form below to post them.