- December 21, 2020 Do we get tax benefits on Personal Loan?

- December 18, 2020 The solicitors Preston depends on for stress-free compensation claims

- December 16, 2020 eToro: History and Key Features

- December 11, 2020 Canadian Dollar Pauses 2020 Rally Against US Peer Amid Falling Crude Prices

- December 11, 2020 Pound Crashes Against Dollar As No-Deal Brexit Appears Imminent

- December 11, 2020 USD/JPY 104.57 High Starting a New Bearish Leg?

Day: March 30, 2015

March 30

March 302015

Euro Falls vs. Dollar, Resilient vs. Other Majors

With debt issues of Greece and quantitative easing from the European Central Bank, the euro had plenty of reasons to drop and it did so against the US dollar. Surprisingly enough, the currency moved sideways against the Great Britain pound and even gained on the Japanese yen. Talks between Greece and its European creditors reached impasse yet again as Greece’s plans for economic reforms were found inadequate. This means that the threat […]

Read more March 30

March 302015

Dollar Has Bullish Setup Ahead of NFP

The US dollar has been in a corrective mode lately but was attempting to renew its rally for the last several trading sessions. Is this a sign of resumption of a bullish trend or just a noise on the market? The greenback was struggling to regain its footing during the past week. The string of poor macroeconomic reports was hampering such attempts while the speech of Janet Yellen, Chairperson of Federal Reserve, supported the US currency in its struggle. […]

Read more March 30

March 302015

Yen Falls with Japan’s Industrial Production

Japan’s industrial production declined last month, resulting in a drop of the Japanese yen during the current trading session. The yen fell against the US dollar and even against the euro, though it fared better versus other currencies. Japan’s industrial production was down 3.4 percent in February, almost two times the value forecast by experts. This made the yen vulnerable to its rivals. Still, the Japanese currency managed to hold ground […]

Read more March 30

March 302015

Australian Dollar Gets Beaten by US Currency

Commodity currencies were on the back foot today as the US dollar continued to fight for dominance on the Forex market. The Australian currency was among losers falling for the fourth straight trading session against its US peer and the Japanese yen. The greenback was fighting downside pressure last week and continued its battle today. So far, it is winning, and this put other currencies on the back seat. Currencies linked to performance of raw […]

Read more March 30

March 302015

Dollar Regains Strength as Week Starts

The US dollar was struggling to gain ground on Friday following the initial losses and had a limited success. The US currency had to wait for Monday to really regain its strength. The greenback gained on the euro during the current trading session but has trouble to follow through with its rally. EUR/USD is consolidating right now even though the recent US economic data was favorable to the dollar. Personal income increased 0.4% […]

Read more March 30

March 302015

Will Fed Raise Interest Rates in 2015?

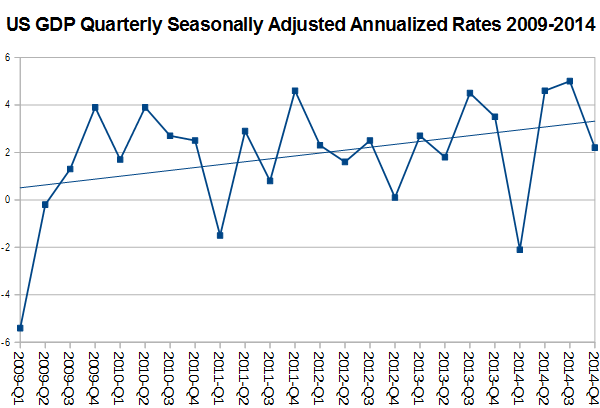

This post’s titular question is probably the most important one for the long-term FX traders, or at least for those who trade USD pairs. Looking at my last attempt to outsource the prediction of the future interest rate increase by the Federal Reserve, I realize that it does not look very good. The vast majority of blog’s readers (56%) expected the rates to go up in 2014 and only 11% of voters chose 2015 as the year of the first lift. […]

Read more